Japanese CPI data is due at 2330 GMT (22 February 2018), I posted a preview of it earlier here

Another, via ...

Société Générale ... (this is excellent, check it out)

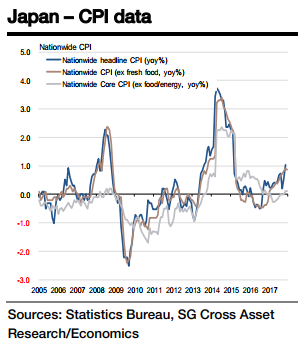

Price growth has continued to pick up after turning to positive in January and having accelerated throughout 2017.

- However, the deceleration in January is likely due to a base effect from the previous year.

- The trend of continued price growth has probably remained unchanged.

Abenomics has not just led to a weak yen and temporary increases in demand, but has in fact had a significant effect on the structure of the economy by sustaining growth driven by domestic demand.

- As evidence of this, profit margins for non-manufacturers - who are more affected by domestic economic conditions - have continued to grow and are now at historically high levels. Up until now, growth in profit margins was probably not only driven by the increase in demand but also by productivity and efficiency gains generated by restructuring and streamlining businesses as well. Thus, the increased demand since the start of Abenomics was met by an equal pick-up in supply, which likely led inflationary pressures to remain muted.

However, the latest financial statement statistics indicate that profit margins are starting to peak out. This indicates that businesses are starting to face limits in terms of absorbing increases in costs and wages through productivity and efficiency gains alone.

- Thus, in order to maintain their current profit margins, businesses will either have to further increase sales or start raising prices.

Going forward, we expect businesses to start to increase prices in order to maintain their profitability in light of increased costs driven by a tight labour market and increasing input costs.

- Furthermore, with the annual wage bargaining likely to confirm further wage growth, upward pressure on prices should strengthen further, leading to a further pick up in prices throughout 2018.

- Services will also likely raise prices at the beginning of the new fiscal year in April.

Thus, even with a temporarily strong yen suppressing costs, especially for manufacturers, we expect the overall trend of increasing upward pressure on prices to continue over the coming months.