Japan data - Jibun Bank/Markit preliminary PMIs for September 2019

Manufacturing 48.9

- prior 49.3

Services 52.8

- prior 53.3

Composite 51.5

- prior 51.9

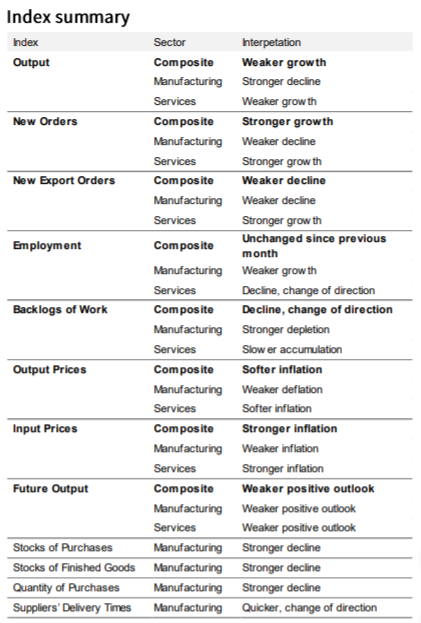

Lower flash readings for both manufacturing and services (and therefore composite also). Services remains in expansion, as does the composite reading.

- Joe Hayes, Economist at IHS Markit:

- "The resilience of Japan's service sector to the struggles of the country's manufacturers continued to shine through during September. As a result, it's looking like Japan will boast what will be a robust rate of growth in the current climate for the third quarter.

- "Anecdotal evidence further highlighted the strong external headwinds Japanese manufacturers were faced with, namely US-China trade tensions, the Hong Kong protests, Brexit and the diplomatic dispute between Japan and South Korea. The positive takeaway remains that symptoms of economic weakness have yet to spread to the services sector.

- "Although, whether the third quarter performance can offset what is likely to be a challenging fourth quarter as consumers and businesses adjust to the sales tax hike is not guaranteed. If history is anything to go by, the final few months of 2019 will be difficult for Japanese businesses and consumers alike."