CIBC sees more dollar strength

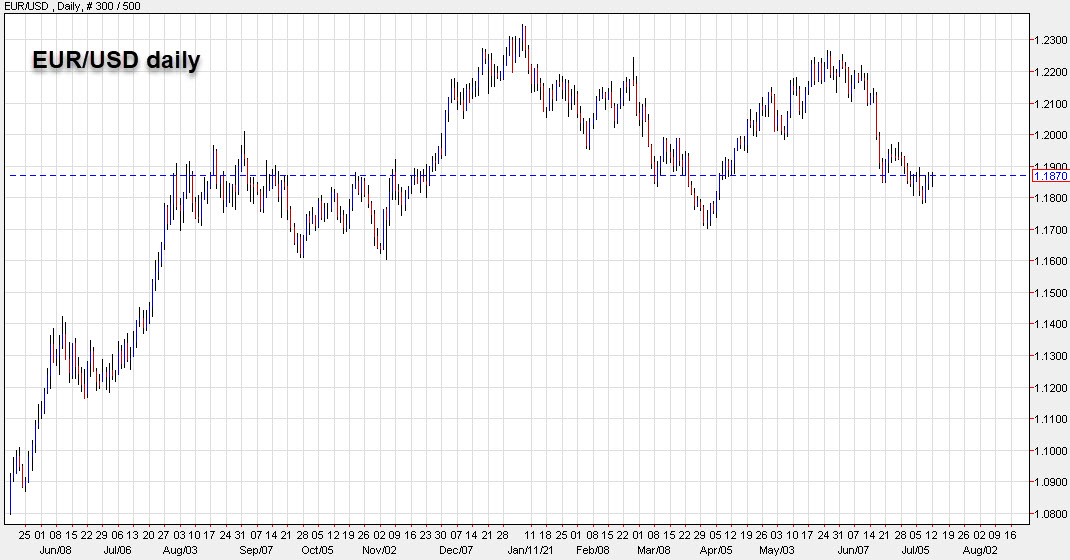

CIBC is out with its latest dollar forecasts and sees the dollar broadly higher in the next six months, with gains against EUR, JPY and CAD.

"The June FOMC meeting marked a turning point for the USD. Prior to the meeting, positioning and sentiment on the greenback was largely bearish," analysts at CIBC write. "Going forward, we now envisage a higher floor for the USD against other currencies. The Fed's pivot marks a transition away from the old reflation narrative towards a new one whereby real yields underperform relative to nominals. That should continue to push USD shorts to exit given the relatively higher yields in the US to other developed markets."

In Q4, they see EUR/USD falling to 1.15, USD/CAD rising to 1.27 and USD/JPY climbing to 112.

Exceptions are in the antipodeans and sterling, which they see as moderately stronger against the dollar. They're particularly constructive on NZD/USD, seeing it climb to 0.7200 in the near term and 0.7600 at the end of 2022.

"Support for NZD/USD is now apparent in the mid-0.6900 range, and should the RBNZ validate the hawkishness of market pricing at their meeting on July 14th, we expect to see NZD/USD regaining ground, potentially toward 0.7200," they write.