A preview of all the numbers that hint at the results of the March 2019 non-farm payrolls report

The US employment report is due at 8:30 am ET on Friday, April 5, 2019:

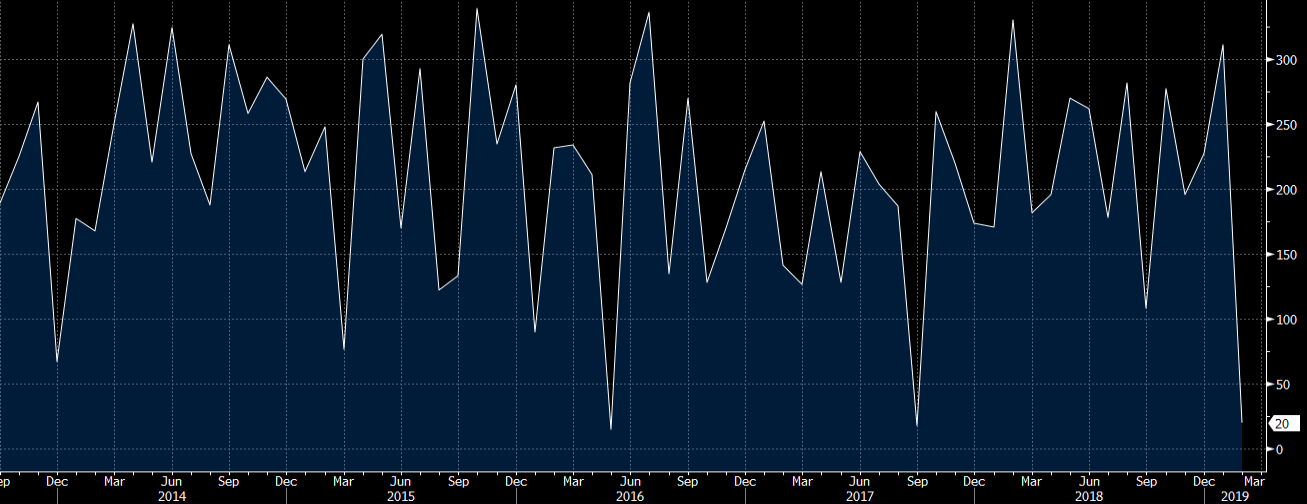

- Median NFP estimate 175K (178k private)

- February 20K (lowest since Sept 2017)

- Highest estimate 277k

- Lowest estimate 145k

- Average estimate 177.8K

- Standard deviation 27.1k

- Unemployment rate exp 3.8% vs 3.8% prior

- Prior participation rate 63.2%

- Underemployment U6 prior 7.3%

- Avg hourly earnings y/y exp 3.4% y/y vs 3.4% prior

- Avg hourly earnings m/m exp +0.3% vs +0.4% prior

- Avg weekly hours exp 34.5 vs 34.4 prior

Here's the March jobs story so far

- ADP 129K vs 197K prior (175K expected)

- ISM non-manufacturing employment 55.9 vs 55.2 prior

- ISM manufacturing employment 57.5 vs 52.3 prior

- Initial jobless claims 4 wk avg 213.5K vs 222.5K prior

- Claims during reference week 217.5K

- Consumer confidence jobs hard to get 13.7 vs 11.7 prior

- Conference board help wanted online demand for hiring 102.3 vs 104.0 prior

- January JOLTS 7581K vs 7479k prior

Last month the headlines were weak but the household survey showed some underlying strength and that kept unemployment low and knocked down U6. The US economy has been a bit of a disappointment this year but I don't think we are going to get another poor jobs number. All the numbers except ADP have been decent and initial jobless claims are at the lowest since 1969.

Here's what Goldman Sachs economists are expecting:

We estimate non-farm payrolls increased 190k in March... Our forecast reflects a boost from weather of around 20k ... While we believe the trend in job growth has slowed from last year's strong pace, renewed declines in jobless claims and the resilience in business surveys suggest that the trend remains nicely above potential.

We estimate the unemployment rate was unchanged at 3.8%... We expect a 0.3% rise in average hourly earnings (mom sa) but we look for the year-over-year rate to fall a tenth to 3.3%