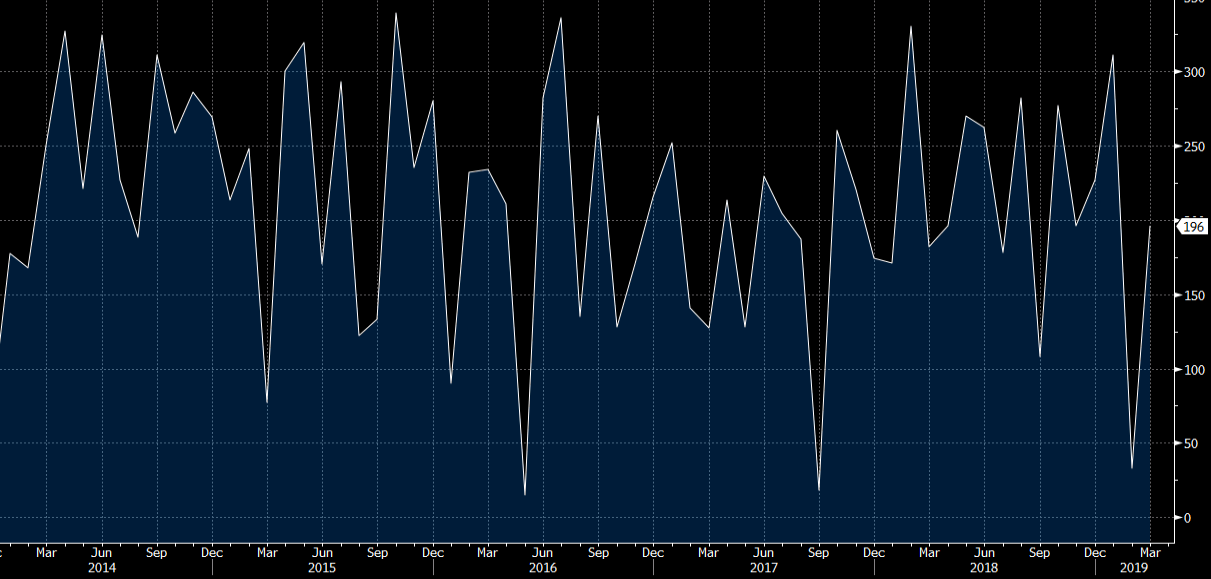

Non-farm payrolls for March 2019

- Prior was +20K (revised to +33K)

- Estimates ranged from 145K to 277K

- Two month net revision +14K

- Unemployment rate 3.8% vs 3.8% expected

- Participation rate 63.0 vs 63.2% prior

- Avg hourly earnings +0.1% vs +0.3% exp

- Avg hourly earnings +3.2% y/y vs +3.4% exp

- Private payrolls +182K vs +177K exp

- Manufacturing -6K vs +10K exp (first decline since Oct 2016)

- U6 underemployment 7.3% vs 7.3% prior

The headline number will relieve a bit of angst after the poor February print but the earnings numbers are poor. For stock markets, this is a bit of a goldilocks number because you have a decent economy without the threat of hikes because of rising wages. However, it's a negative for the dollar because it underscores that the Fed is done hiking for the cycle.

In the household survey the labor force shrank by 224k and employment fell by 201k. This year, employment in the household survey is down 197k, compared to growth in the establishment survey of 541k.