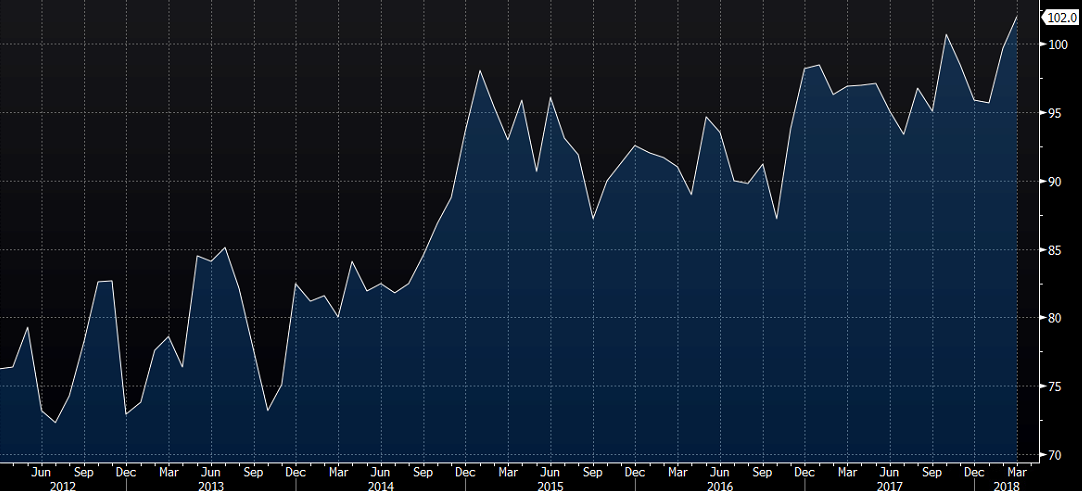

The first reading on US consumer sentiment from the University of Michigan

- Best reading since 2004

- Prior was 99.7

- Current conditions 122.8 vs 114.9 prior

- Expectations 88.6 vs 90.0 prior

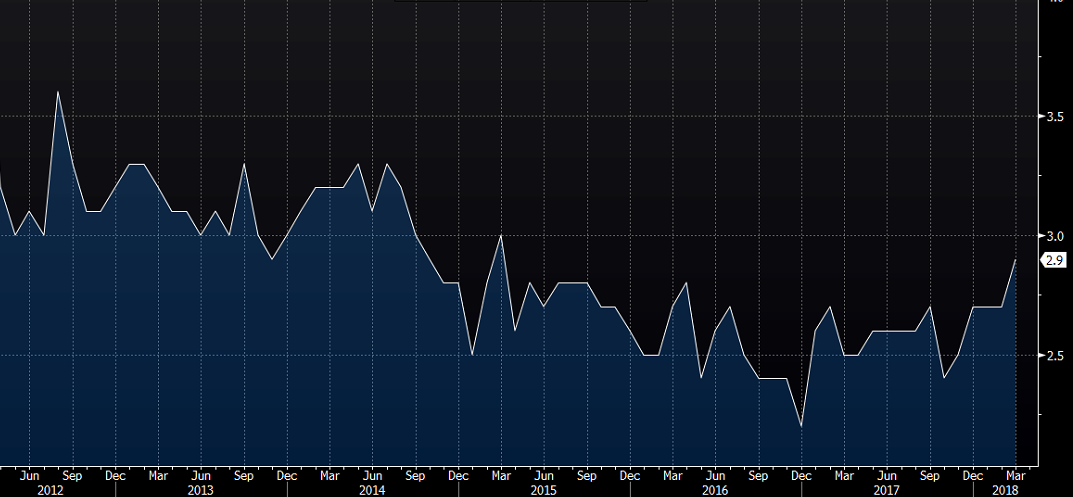

- 1-year inflation expectations 2.9% vs 2.7% prior

- 5 year inflation steady at 2.5%

- "All of the gain in the Sentiment Index was among households with incomes in the bottom third"

- "Favorable mentions of the tax reform legislation were offset by unfavorable references to the tariffs on steel and aluminum-each was spontaneously cited by one-in-five consumers"

- "While income gains are still anticipated, the March survey found that the size of the expected income increase returned to the lows recorded in the past year"

- "Among the top-third income households, income expectations fell more and inflation expectations rose more; as these households account for more than half of all consumption expenditures, the data suggest that the relative lull in consumption in the 1st quarter may persist for another quarter"

- Full report

This is a very good report and is a reason to buy the US dollar. The Fed watches these numbers closely and it will give them more confidence to deliver a hawkish hike next week.

The big story is the jump in one-year inflation expectations to the best level in years.