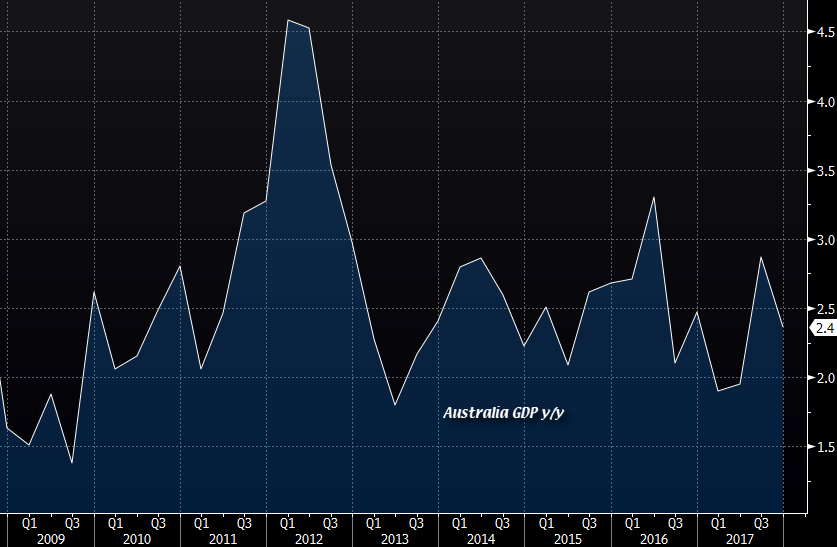

Australia released its Q4 GDP report earlier, which was weaker than expected

The report can be found here, as covered by Eamonn. Here are more responses on the matter:

Commonwealth Bank of Australia (Gareth Aird)

"The Q4 GDP outcome was lower than the latest RBA forecasts. But Governor Lowe earlier today stated that although the economy was likely to have ended 2017 a little softer than previously thought, it does not change the RBA's assessment of the outlook. As a result, we don't think that the policy dial has shifted on today's data. Rates will stay on hold until wages growth and core inflation are on a sustained upward trend. That still looks to be some way off so the cash rate should stay anchored at a record low for most of the year".

ANZ Bank (Felicity Emmett)

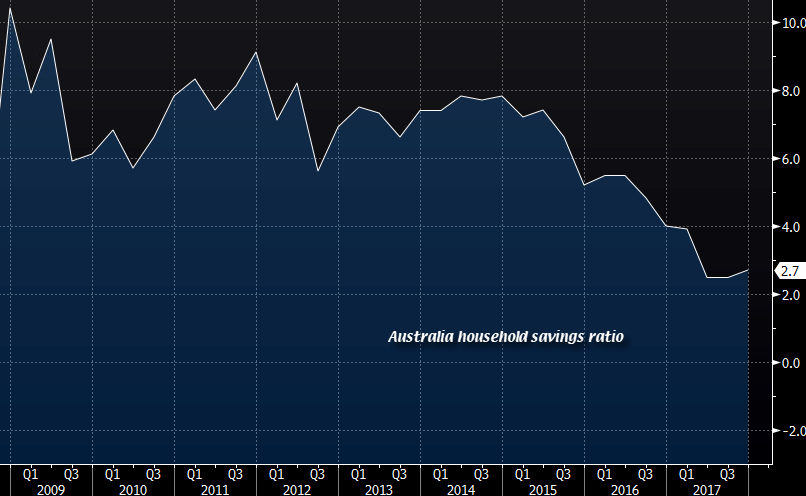

"The result highlights the still patchy nature of growth and the subdued nature of inflationary pressures in the economy. While the pick-up in consumption is reassuring, it needs to be considered in the light of the ongoing downtrend in the saving rate. We would point out, however, that the soft tone to GDP is at odds with the strength in business conditions and the labour market. We are reluctant at this stage to extrapolate the weakness into 2018, and continue to expect a strengthening of growth this year. The weakness in wage growth confirms that the RBA is likely to be on hold for some time yet".

JP Morgan (Ben Jarman)

"Even with the stronger investment and export outcomes we expect, the consumer is a significant constraint to GDP growth moving back up above 3% in the near-term, per the RBA's forecasts. The staff projected 3.25% year-on-year growth by the end of 2018 in the February SoMP, though the Governor's language in the last couple of days reflects some back-pedalling from this. Another set of downward revisions in the next forecast round in May would underscore the fact that the RBA will lag the global rate normalisation process by some distance".

The consensus here seems to be that the RBA will have to stay on hold for quite some time more, and that the uncertainty of that period remains ironically, uncertain still.

Personally, I feel that as long as the savings ratio remains sluggish, it's tough to see a pickup in consumption to boost economic growth. The reading came in at 2.7, which showed that savings grew again, but the pace is well off compared to the highs during 2010-2015.