Australian February trade balance is due at 0130 GMT on 5 April 2018

Preview via NAB:

NAB is expecting a modest increase in the trade surplus to $1.4b

- Imports are expected to soften a little further from the December spike;

- while exports should rise on the back of the ongoing pick up in LNG exports, and moderate increases in coal and iron ore. Growth in export values are expected to be partly offset by reduced non-monetary gold exports, which recorded a sharp rise in January

Preview via Westpac:

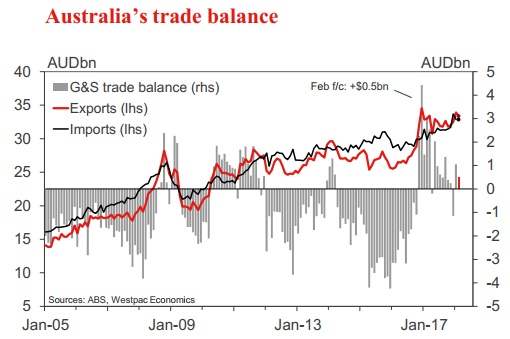

Australia's trade account recorded a surplus of $1.06bn in January as exports lifted 4.3%, boosted by a $0.8bn spike in gold shipments.

For February, the trade surplus is expected to narrow to $0.5bn, impacted by a pull-back in gold exports.

- Export earnings are forecast to decline by 1.6%, down $550mn. An expected $0.8bn pull-back in gold is only partially offset by a lift in LNG volumes, on expanding capacity, and a lift in coal shipments.

- Imports are expected to be unchanged in the month. A weaker currency, down 1.8% on a TWI basis and 0.8% lower against the US dollar, will see the cost of imports rise. However, we anticipate an offsetting moderation in fuel imports following two particularly strong months.