The CPI report is due on Wednesday

The US consumer price index report for March is due at 8:30 am ET on Wednesday.

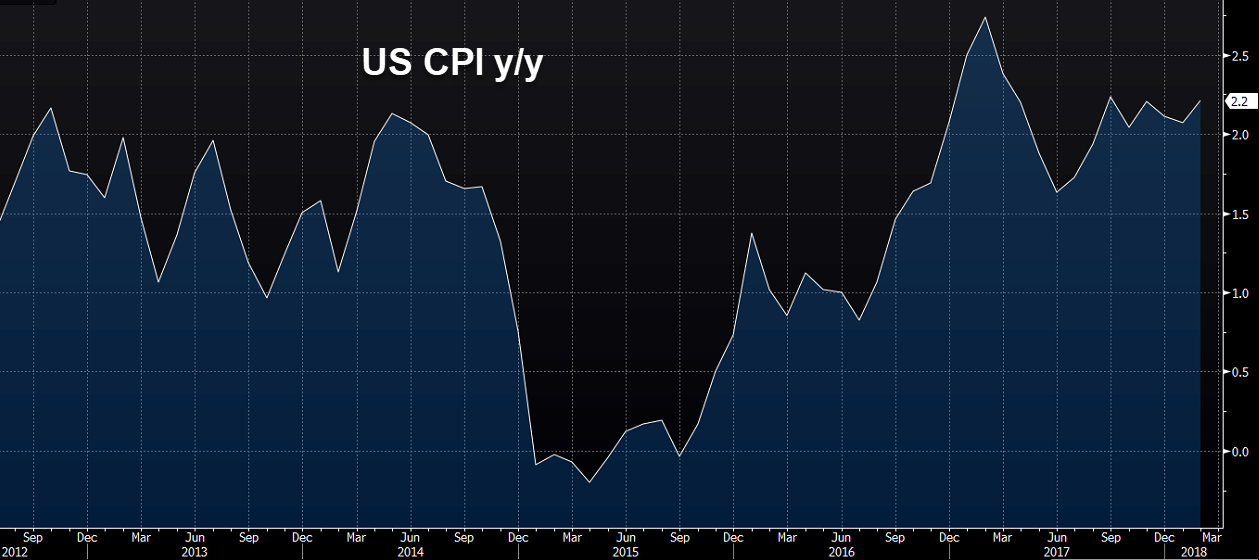

While trade concerns are dominating markets at the moment, the Fed remains preoccupied with solving the inflation puzzle. Although the Fed prefers the PCE inflation benchmark, CPI is also a key input. Despite better jobs and growth, both price measures have been slow to respond. That's sparked a debate about the Phillips Curve but most FOMC members publically say they expect inflation to tick up soon.

That uptick will likely begin Wednesday with year-over-year CPI rising to a one-year high of 2.4%, up from 2.2% in February. That would be the highest since last March.

The Fed will also want to drill down into the numbers. The core reading, which excludes food and energy is forecast to rise to 2.1% from 1.8%. That would also be the highest since last March.

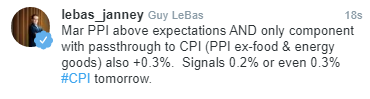

Markets will react more to how the numbers perform relative to expectations so it's all about the consensus. On that front there is some small bias toward the upside after Tuesday's PPI report was higher than expected.

Here's fixed income strategist Guy Lebas from Janney, Montgomery, Scott.

He's referring to core m/m CPI, which is expected up 0.2% m/m. Headline CPI is expected up 0.0% m/m.

Oftentimes, the m/m figures are valuable because they are less likely to impacted by one-offs that might have affected the market a year ago. However make sure to drill down into the decimal places because +0.2% m/m could be +.151% or +0.249% due to rounding.