The Reserve Bank of New Zealand has left its official cash rate unchanged as was expected. Here is the monetary policy statement (headlines):

The Bank has lowered its outlook for rates ahead, NZD taking a hit

- RBNZ sees official cash rate at 1.8 pct in December 2018 (pvs 1.8 pct)

- Sees official cash rate at 1.8 pct in September 2019 (pvs 1.9 pct)

- Sees official cash rate at 1.8 pct in December 2019 (pvs 1.9 pct)

- Sees official cash rate at 2.3 pct in September 2021

- Sees NZD TWI at around 72.8 pct in September 2019 (pvs 74.0 pct)

- Sees annual CPI 1.8 pct by September 2019 (pvs 1.6 pct)

The Statement has changed considerably, but the gist is in those headlines, RBNZ cutting its expected rate path lower

More:

- RBNZ says we expect to keep the OCR at this level into 2020

- Says direction of next move could be up or down

- Recent growth has moderated, we expect it to pick up pace over rest of this year

- Robust global growth and lower kiwi will support export earnings

- Capacity and labour constraints promote business investment, supported by low rates

- Labour market has tightened and employment is roughly around max sustainable level

- Expects unemployment rate to decline modestly from current level

- Welcome early signs of core inflation rising

- Says government spending and investment also set to rise

- Says residential construction and household spending remain solid

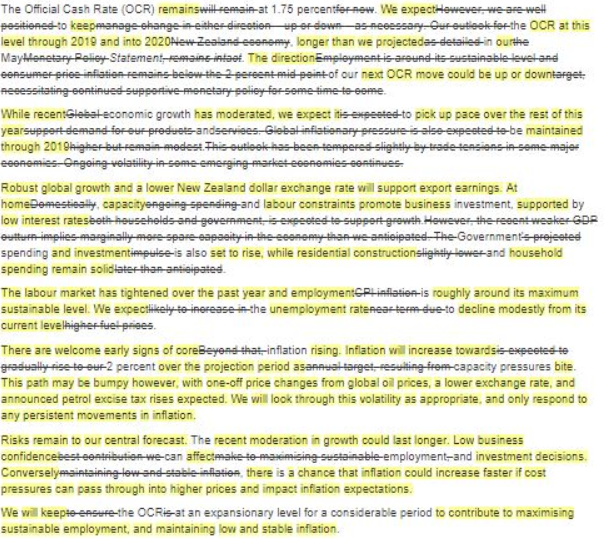

A pic of how Governor Orr's statement changed:

--

And still to come from the RBNZ at 2200GMT Governor Orr press conference

--

For background on this, previews: