Société Générale commodities research with a summary of what is to drive oil.

The analysts say there have been many key supply developments in recent weeks that are, on balance, more bullish short term than before. SG summarise:

OPEC+ will be increasing crude output by 1 Mb/d.

- Saudi Arabia and Russia are well on their way to making this happen, with a combined 550 kb/d gain in June.

However, other factors combine to make the overall picture more bullish.

- Spare capacity is getting tight: by the end of July, total spare capacity could be down to 1.0-1.5 Mb/d.

- Sanctions on Iran are expected to have a bigger impact: we now forecast Iranian output and exports to be cut by 1.0-1.3 Mb/d.

- If the Saudis and others replace the losses from Iran, there will be basically no spare capacity left.

- There are also outages in Libya and Canada that total 1.2 Mb/d.

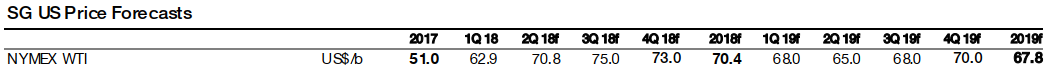

SG forecasts:

We maintain and reiterate our current/latest price forecasts

Our conviction level is medium

There is considerable uncertainty in the oil market

Upside risks to our outlook mainly relate to the supply side, and come from geopolitical risks and crude supply disruptions.

Downside risks to our outlook mainly come from slower global economic and oil demand growth; we are particularly concerned about increasing global trade tensions. We view the upside risks and downside risks to our base case forecasts as balanced.