The Monetary Authority of Singapore is working with private industry to bypass routing trades via Tokyo or London.

- Building trading engines in Singapore itself, which will speed trades; UBS and Citi have already done so.

- Further, the government is offering tax incentives to enhance Singapore's appeal as a hub to trade

Adds Bloomberg:

- The heart of the challenge for Singapore is latency -- the 10th of a second extra it takes to route a trading order through servers in Tokyo or London or New York, where most major banks have traditionally sited their trading engines. To capture big-volume players like hedge funds and high-frequency traders, the government needs to persuade companies to build those expensive systems and data centers in Singapore.

An interesting read, link is here. ( …. eventually ;-) )

----

Also, you'll have seen this earlier:

Japanese financial markets are closed for 10 consecutive days from April 27 - May 6

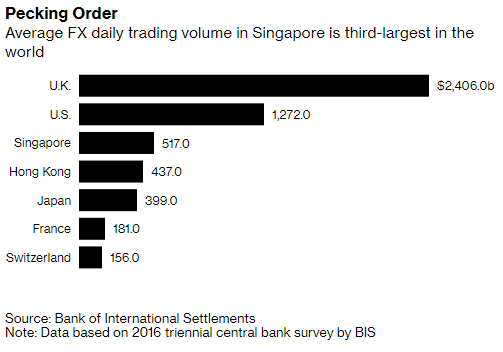

You can get an inkling of the impact on FX liquidity in the Asian timezone with a glance at a graphic in that Bloomberg story linked above: