Its a big economic data hour coming up from Australia:

0100 GMT Australia, Melbourne Institute (MI) Inflation Gauge for August

- prior was 0.1% m/m and 2.0% y/y

- Trimmed mean' was 0.0% change m/m, and for the y/y 2.1%

0130 GMT Australia, more indicators for the Q2 GDP that'll publish September 5

- Company operating profit for Q2, expected is 1.3% q/q, prior was 5.9%

- Company inventories for Q2 (sa) expected is 0.2% q/q change, prior was 0.7%

- Inventory is an input to GDP, its a volatile data point and difficult for the forecasters

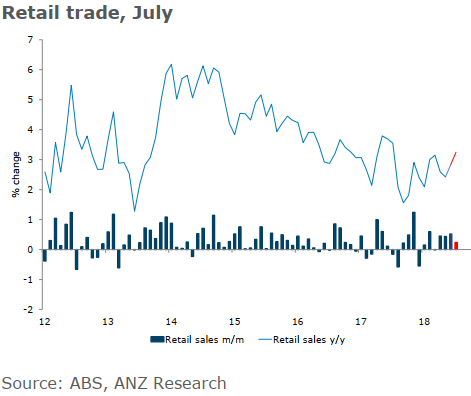

0130 GMT Australia Retail Sales for July

- expected 0.3% m/m, prior 0.4% m/m

- I'll have more to come on this separately

0130 GMT Australia ANZ job ads for August

- prior +1.5% m/m

Previews posted already:

- Australian retail sales data due today - preview of the July data

- Big Aussie economic data day coming up - preview of Q2 inventories

Here is ANZ an what they expect from the retail sales info:

- We expect retail sales growth to slow-down somewhat after three consecutive strong monthly results. Falling nationwide house prices, softening consumer sentiment and a significant decline in surveyed business conditions all inform our view. The 2.2% fall in the petrol prices in July provides some offset. Interestingly, though, our Random Forecast model is pointing to a stronger result, of 0.4% m/m