A theme for 2020?

The ceasefire in the US-China trade war has everyone thinking about global growth and reflation in 2020.

The winners in that trade will be commodities, emerging markets and commodity currencies. The low yielders and US dollar will be on the defensive. That's exactly what's happening today in what's usually one of the quietest days of the year but has included some decent-sized moves today.

At the top of the heap is the commodity bloc.

What's especially notable from the trio of commodity currencies here is the AUD/USD chart and its continued break above the 200-day moving average.

I'm skeptical of technical breakouts at this time of year but the rise today also breaks the December high of 0.6939 and there isn't much in the way of resistance.

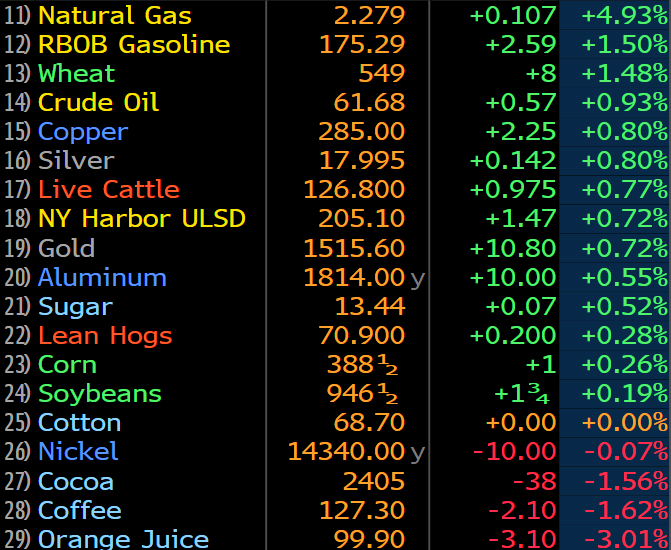

On the commodity side it's energy that's leading the way higher with natural gas bouncing back from a Christmas Eve beating but a bit further down the list, crude is now creeping towards $62. A level to watch there is $62.90, which was the closing level after the Saudi attack.