What events and releases will impact trading in the week starting Jan 16th.

- ECB interest rate statement. Thursday 7:45 AM ET/1245 GMT. ECB Draghi press conference to follow at 8:30 AM ET/1330 GMT. The ECB will meet next week and announce that rates will remain unchanged. The last meeting the ECB moved increase the types of bonds that could be purchased for QE purposes (read German notes). That included bonds with yields below the -0.4% deposit rate. In addition, they lowered the maturity requirement to one-year from two- years (read German notes). However, they also reduced the amount of QE purchases from 80B Euro to 60B Euro until the end of December. There will be no change in policy, nor change in QE. So the focus will be squarely on the comments from Draghi during his traditional prepared statement and then Q&A. Will he sway more toward the hawkish Germans or keep committed to the the same path..

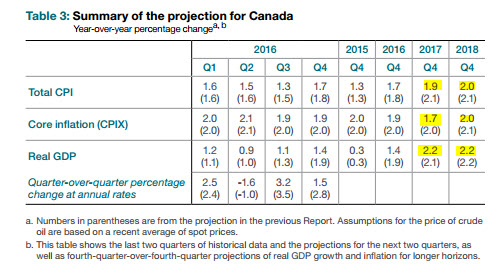

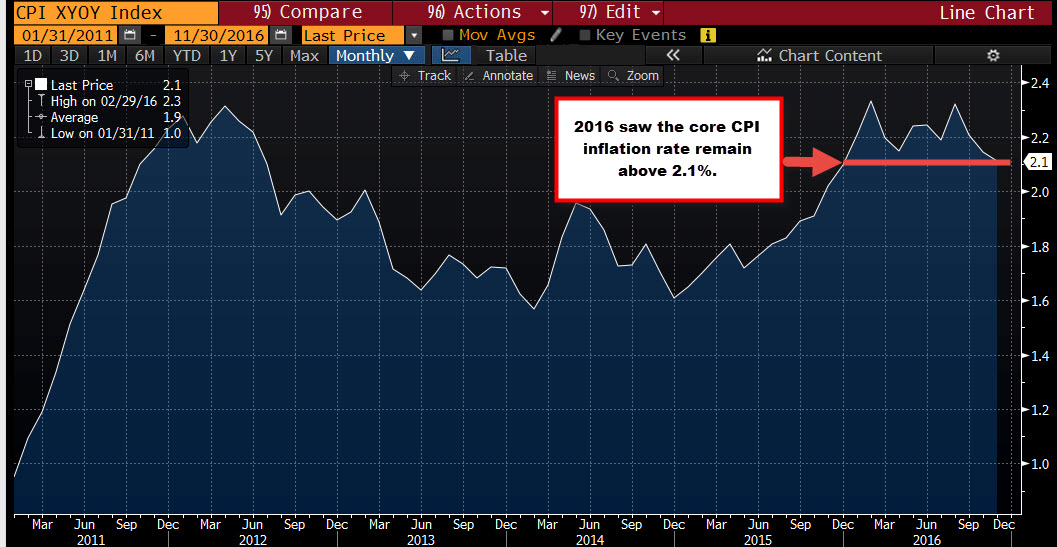

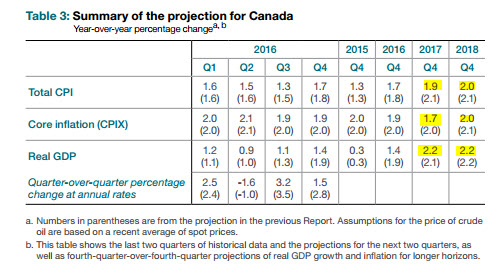

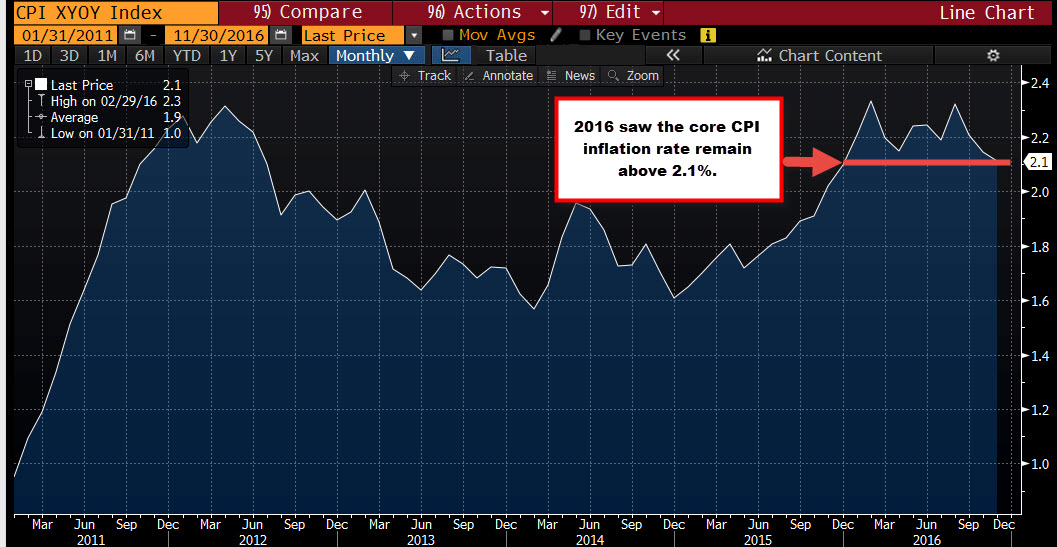

- Bank of Canada rate statement. Wednesday at 10 AM ET/1500 GMT. Press conference at 11:15 AM ET. The bank will also release its quarterly Monetary Policy Report (MPR) at 10 AM ET. Stephen Poloz and Senior Deputy Gov. Carolyn Wilkens will give a statement and hold a press conference. The rate is expected to remain unchanged at 0.5%. In their last MPR, they saw 2017 CPI at 1.9% and core CPI at 1.7%. That was down from earlier projections of 2.1% and 2.0% respectively. For GDP they estimate growth of 2.2% (up from 2.1%).

- US CPI/Core CPI. Wednesday at 8:30 AM ET/1330 GMT. The US will release consumer price data for December with expectations for MoM rising by 0.3% (vs. +0.2% last month). The Ex Food and energy is expected to increase by +0.2% (vs +0.2% last). The YoY numbers are expected to rise to 2.1% from 1.7% and 2.2% from 2.1%. The core YoY ended 2015 at 2.1% with the high extending to 2.3% in Feb and again in August

- Australia employment change. Wednesday at 7:30 PM ET/Thrusday 0030 GMT. The Australian employment report is expected to show employment change of 10.0K vs 39.1K last month. The gain last month was well above the estimate of 17.5K. The unemployment rate did move higher to 5.7% last month from 5.6%. The estimate is for the rate to remain at 5.7%. Last month full time employment rose by 39.3K. The part time employment fell by -0.2K.

- UK Retail sales. Friday at 4:30 AM ET/0930 GMT. The November retail sales in the UK are expected to to dip by -0.1% vs. +0.2% estimate last month. Ex auto fuel a larger -0.4% decline is forecast. The YoY changes are expected to show healthy 7.2% and 7.5% gains respectively.

Other key events/releases

- Fed Chair Yellen is scheduled to speak at the Commonwealth Club of SF on Wednesday at 3 PM ET/2000 GMT, and also on Thursday at 8 PM ET/Friday 0100 GMT) at Stanford Institute for Economic Policy research.

- BOE Carney is speaking on Monday at 1:30 PM ET/1830 GMT at the London School of Business. The title is "Policy Issues affecting the Bank of England"

- UK employment data will be released on Wednesday at 4:30 AM ET/0930 GMT.

- Canada Manufacturing sales are to be released on Thursday at 8:30 AM ET/1330 GMT with expectations of +0.2% vs -0.8% last

- Canada CPI will be released on Friday at 8:30 AM ET The monthly retail sales will also be released

On the political front (thanks)

- UK PM May speaks on Brexit will speak on Tuesday in what's been touted as a major speech.

- King...I mean President Trump has his inauguration on Friday