Latest data released by Markit/CIPS - 23 November 2021

- Prior 59.1

- Manufacturing PMI 58.2 vs 57.3 expected

- Prior 57.8

- Composite PMI 57.7

- Prior 57.8

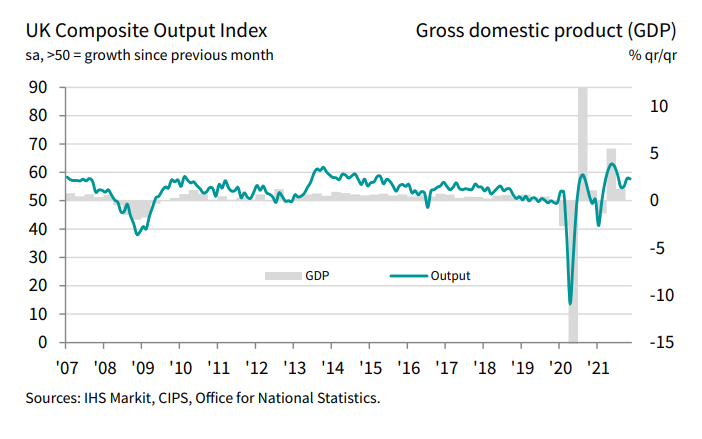

A slight softening in the services sector outweighs a mild jump in manufacturing output, bringing overall business activity in the UK to a two-month low.

However, the standout detail in the report is that the latest increase in average cost burdens was the fastest since this index began in January 1998.

Of note, around 63% of UK private sector companies reported an increase in their average cost burdens during November, while only 1% signaled a decline. Markit notes that:

"A combination of sustained buoyant business growth, further job market gains and record inflationary pressures gives a green light for interest rates to rise in December.

"Output growth across manufacturing and services came in slightly faster than expected in November, albeit heavily skewed towards the service sector as factories continued to struggle with supply shortages and falling exports.

"Encouragingly, an acceleration in growth of new business hints that December should bring a strong end to the year, meaning the fourth quarter should see a welcome pick up in GDP growth after the slowdown seen in the third quarter.

"For policymakers concerned about the health of the labour market after the end of the furlough scheme, the buoyant jobs growth signalled should bring some reassuring comfort.

"A record increase in firms' costs will meanwhile further stoke fears that inflation will soon breach 5%, with lingering near-record supply delays adding to indications that price pressures may show few signs of abating in the near-term.

"The relatively poor performance of manufacturing is likely to remain a concern for some time, however, as is the potential to see tighter growth-inhibiting COVID-19 restrictions applied amid high COVID-19 case numbers both at home and now also in continental Europe. The latest survey results will none the less likely shorten the odds of an interest rate hike at the Bank of England's December meeting."