Highlights of the January US personal income and spending report

- Prior was +1.5%

- Month-over-month at +0.3% vs +0.3% exp

- Prior m/m +0.3%

- PCE deflator 1.7% y/y vs 1.7% exp

- Prior deflator 1.7%

- Deflator m/m +0.4% vs +0.4% exp

- Prior deflator m/m +0.4%

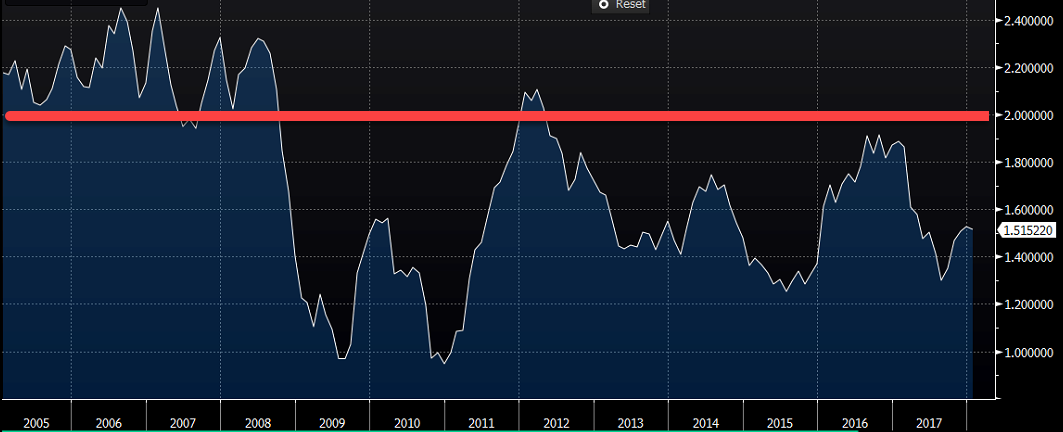

This was the last look at PCE inflation before the Fed's March meeting. There were no surprises here. The Fed has met its inflation target for 4 months since 2008, or 4 of 100 months.

- Personal income +0.4% vs +0.3% expected

- Personal spending +0.2% vs +0.2% exp

- Real personal spending -0.1% vs -0.1% exp

- Prior real personal spending +0.3% (revised to +0.2%)

- Savings rate 3.2%

- Pay adjusted for inflation and taxes +0.6% m/m -- most since Dec 2012 but it was likely due to one-time bonuses

There was a big of improvement in personal income and the savings rate ticked up but there isn't much to get excited about. February is when the tax cut should really start to deliver a boost.