US June 2021 retail sales data

- Prior was -1.3% m/m (revised to -1.7%)

- Retail sales ex autos +1.3% vs +0.4% expected

- Prior ex autos -0.7% (revised to -0.9%)

- Retail sales control group +1.1% vs +0.4% expected

- Retail sales ex auto and gas +1.1% vs -0.8% prior

- Ex autos/gas/building materials/food services +1.1% vs -1.4% prior

- Full report

Sales are up 18.0% above the June 2020 level.

Some key categories (m/m):

- Food services and drinking places +2.3%

- Non store retailers (online) +1.2%

- Clothing and accessories +2.6%

- Gasoline stations +2.5%

- Electronics and appliances +3.3%

- Furniture -3.6%

- Motor vehicle and parts dealers -2.0%

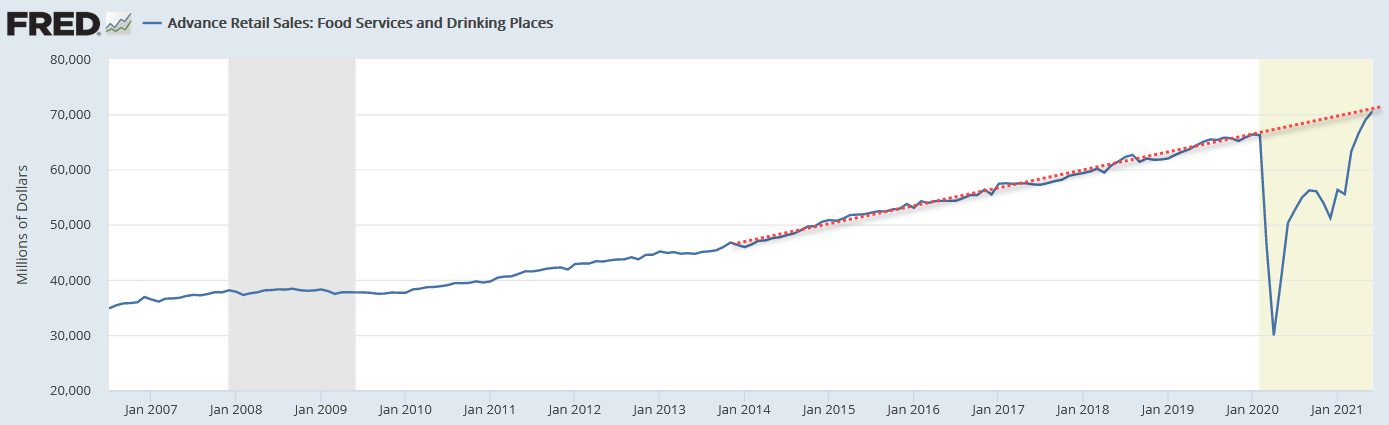

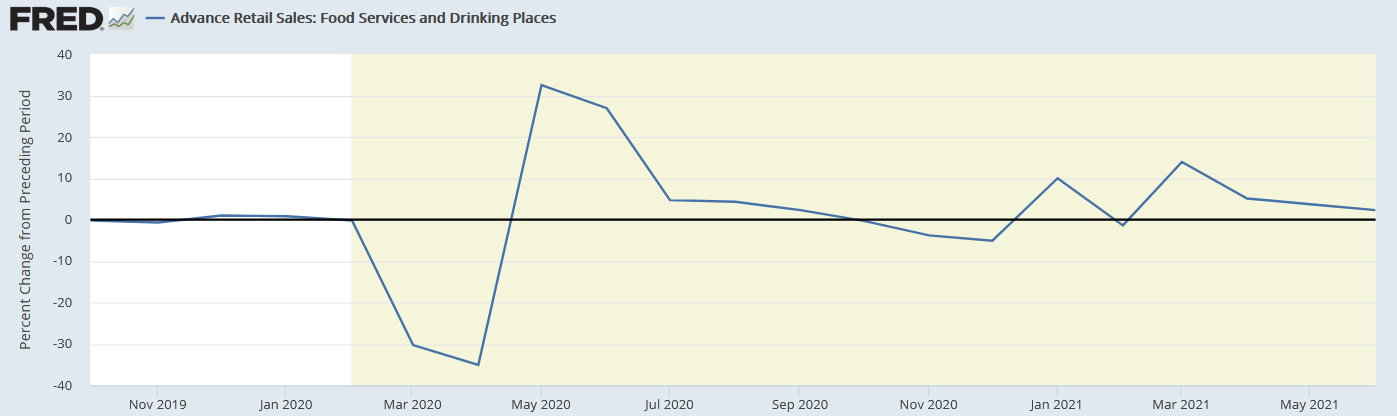

The 'food services and drinking places' is the cleanest category to evaluate the reopening and how much of the pent up savings people will spend. The 2.3% climb follows a 3.7% rise in May and a 5.1% rise in April.

Here's another way of looking at it. You can see that it's back on trend. What you would expect though (especially if you're looking for a reopening boom) is an overshoot for a number of months and a burst of spending.