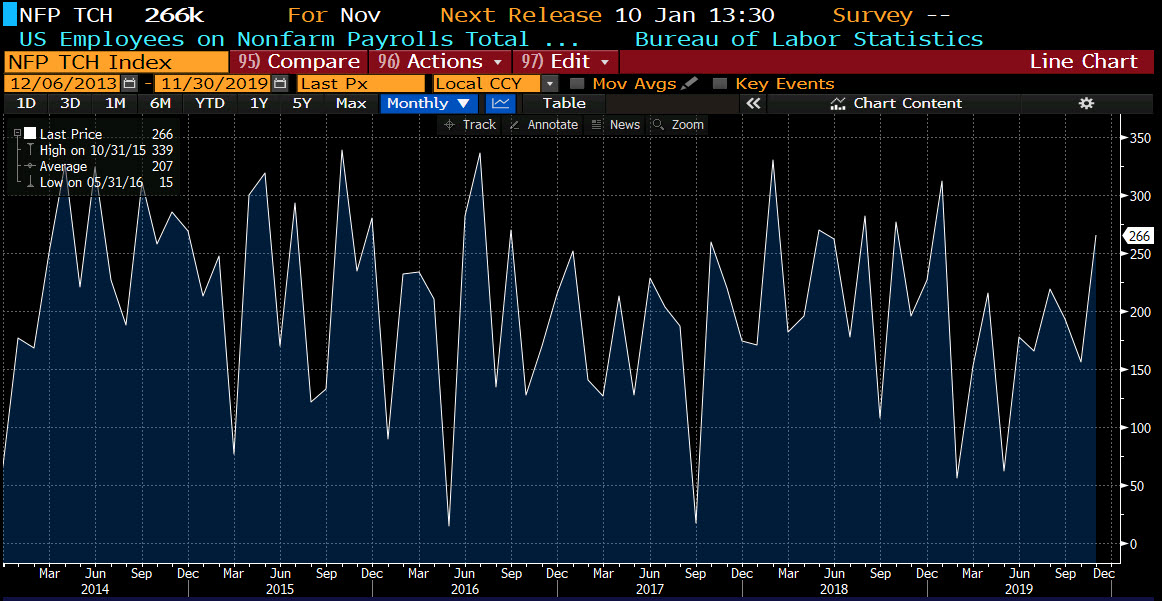

US nonfarm payroll for November 2019

- Change nonfarm payroll 266K versus 180 K estimate

- 2 month payroll net revision +41K

- Change in private payroll 254K versus 178K estimate

- Manufacturing payroll 54K versus 40K estimate

- Unemployment rate 3.5% versus 3.6% estimate

- Average hourly earnings MoM 0.2% versus 0.3% estimate

- Average hourly earnings YoY 3.1% versus 3.0% estimate

- Average weekly hours 34.4 versus 34.4 estimate

- Llabor force participation rate 63.2% versus 63.3% last

- Underemployment rate 6.9% versus 7% last

Other details:

Goods producing, +48 k

- construction, 3K

- manufacturing, 54K

service producing jobs, 249K

- trade, transport +14 K

- transportation and warehousing +14 K

- information +13 K

- financial +13 K

- business services +49K

- leisure +45K

- education and health services plus 74K

- government +12 K

The data blows away the estimates. The dollar has moved sharply higher with the dollar yen extending above its 100 hour moving average at 108.82 from a prerelease level 108.54

In other markets,

- spot gold is trading down $8.40 or -0.56% at $1467.70

- WTI crude oil futures are not impressed. They still trade OPEC with a move down by $0.59 or -1% at $57.84

in the US stock market the major indices have moved higher:

- Dow, +138 points

- S&P index up 15 points

- NASDAQ index up 46 point

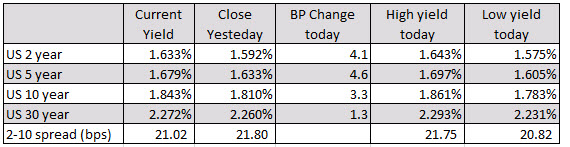

US yields have moved higher with the 10 year up 3.3 basis points. The 2 year is up the most. It has risen by 4 basis points as the Fed is most definitely on hold.