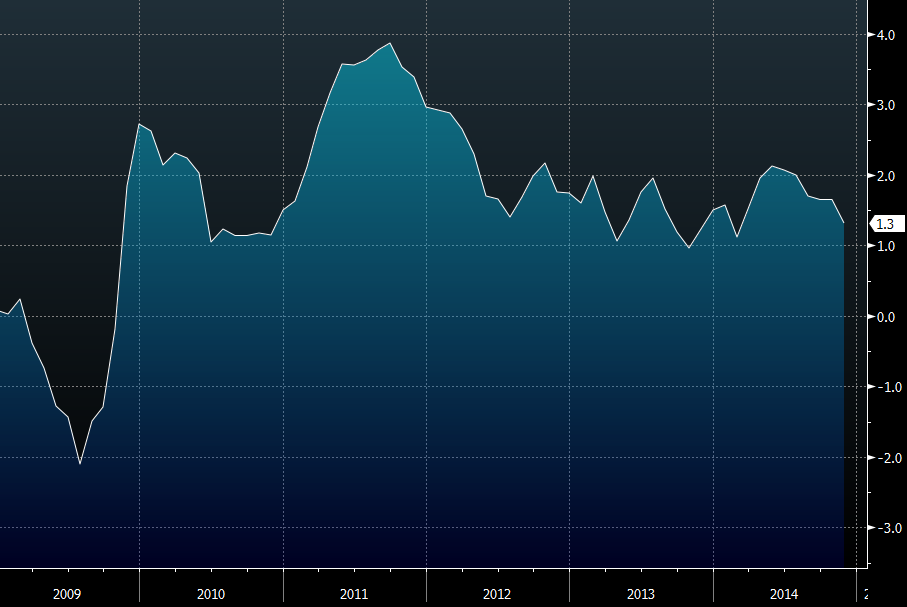

Highlights of the November CPI report:

- Prior reading was 1.7% y/y

- Ex-food and energy 1.7% vs 1.8% y/y

- Prior ex-food and energy was 1.8%

- Overall CPI -0.3% m/m vs -0.1% exp — largest monthly drop since 2008

- Prior m/m reading was 0.0%

- Ex-food and energy 0.1% vs 0.1% exp

- Prior m/m ex-food and energy was +0.2%

- Real weekly earnings +0.9% vs +0.3% exp

- Prior real weekly earnings +0.4% m/m (revised to +0.1%)

This is the final data point for the Fed before the FOMC decision at 2 pm ET (1900 GMT). The US dollar is broadly, albeit moderately, lower after the data with USD/JPY at 117.00 from 117.17 before the numbers. US stock futures added to gains.

The high weekly earnings data throws a wrench into the equation because those wage gains are what the Fed wants to guard against.

CPI y-y