Chris Weston from Pepperstone breaks down the euro and the week ahead

I have put a detailed video together, firstly reviewing market moves this week, with a specific focus on last night's ECB meeting and the impact on the EUR crosses. But also the week ahead and the event risk through which you, as traders, will have to navigate.

Of course, the key event will be the FOMC meeting, and I touch on that in greater depth, but there are other key data points and macro thematic we need to be aware of. I also take a look at a number of key setups that have come across my radar.

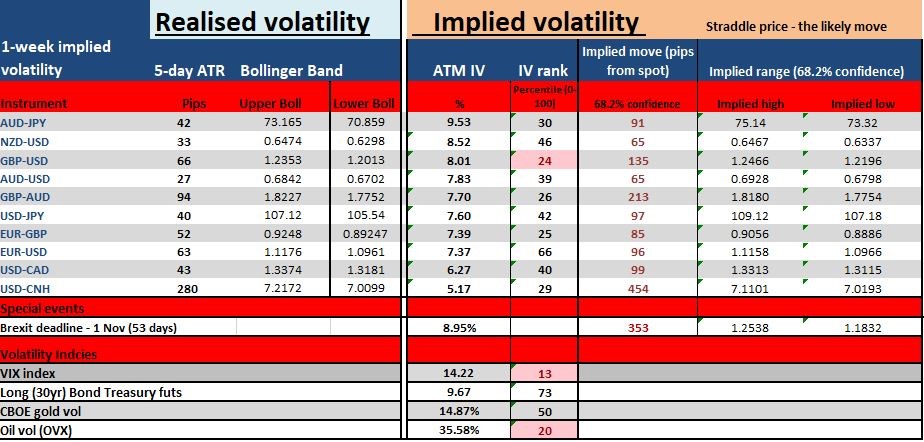

I'll update these key trading variables early in the week, but 1-week implied volatility does take into account the FOMC meeting, so I don't think it is certainly relevant. Using this volatility, we can assess the expected move (up or down), which can define our risk and position sizing.

In this section I have looked at the current Commitment of Traders report, options skew (the difference between 25 delta put and call volatility) and rates expectations. All of these off insights into our risk-to-reward profile.