The FOMC meeting is the key focus in the day ahead

As such, one can expect quieter tones to prevail in the run up to that and in the European morning session ahead. As for what to expect from the Fed, I outlined some thoughts earlier in the week as per below:

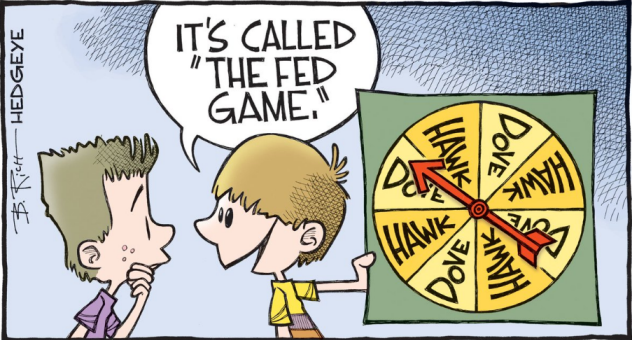

I believe this one will be a bit more straightforward. However, the market reaction may not quite be as what the Fed may want it to be perhaps.The recent flattening of the yield curve perhaps suggests something is awry with the financial outlook - one way or another - and even if the Fed plays its cards right, we may still see the trend continuing over the next few weeks.The market is expecting a taper announcement by the Fed this week and they will surely deliver on that. The question then becomes how far are they willing to go to make clear that the taper process is not going to be correlated or isn't going to translate immediately to rate hikes going into next year.In that lieu, I would expect the Fed to reaffirm that they can opt to delay or slow down the taper process depending on market conditions but that will largely be semantics.At the end of the day, the Fed is familiar with all this bullying and so is the market. I reckon that might not change until policymakers offer up a firm voice on the matter.

It's all about seeing how much the Fed wants to push back against rate expectations, very much similar to the RBA situation going into yesterday's meeting decision.