Fed speak will be one of the highlights

The Fed dominated the past week and it will likely be more of the same in the days ahead with a heavy slate of speakers scheduled to offer their thoughts on the stance of monetary policy.

Monday:

- Bullard

- Kaplan

- Williams

Tuesday:

- Mester

- Daly

- Powell testifies in Congress

Wednesday:

- Bowman

- Bostic

- Rosengren

Thursday:

- Bostic

- Harker

- Williams

- Bullard

- Kaplan

- Fed bank stress tests

Friday:

- Mester

- Rosengren

- Williams

Expect a handful of media appearances as well. If there's a message the Federal Reserve wants to send, they will certainly have an opportunity.

The economic data calendar also has some highlights but the week will start quietly with nothing market moving scheduled for Monday. It picks up from there.

Tuesday:

- Existing home sales

- Richmond Fed

Wednesday:

- Markit manufacturing and services prelim

- New home sales

Thursday:

- Trade balance

- Durable goods orders

- Q1 GDP (third look)

- Initial jobless claims

Friday:

- PCE

- UMich sentiment

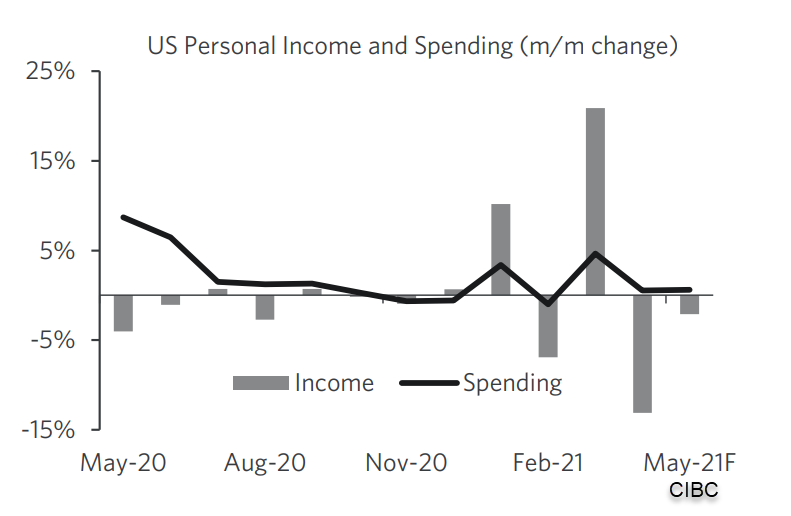

For the PCE report, CIBC forecasts an above-consensus reading of +0.6% on personal spending (+0.3% exp) and is in-line on the +3.5% y/y core inflation number.

"Although households have ample savings as a result of past fiscal stimulus to spend, labor shortages and supply chain issues are proving to be a headwind to activity, while quickly rising prices in some areas of the economy could pose a threat to future demand. The escalation in prices has been expected by the Fed and it will look through the acceleration as transitory and remain focused on the recovery in the labor market."