Yesterday's US CPI report provided more confusion than clarity, if anything else

Treasuries remain sold, equities remain bought, and the US dollar continues to sink. Has anything really changed since January?

The market narrative is a familiar one, and despite all the anticipation and the twist and turns last week, it feels like cross-asset correlation or reasoning is just breaking down. But that's what it is, we're in a new trading paradigm now.

The biggest change here is volatility.

And we're likely going to see more cross-asset volatility from hereon. Equity markets appear to be quick to adjust to higher yields, and I reckon it'll take yields heading towards 3% or higher to start spooking investors once again on talks of portfolio re-balancing.

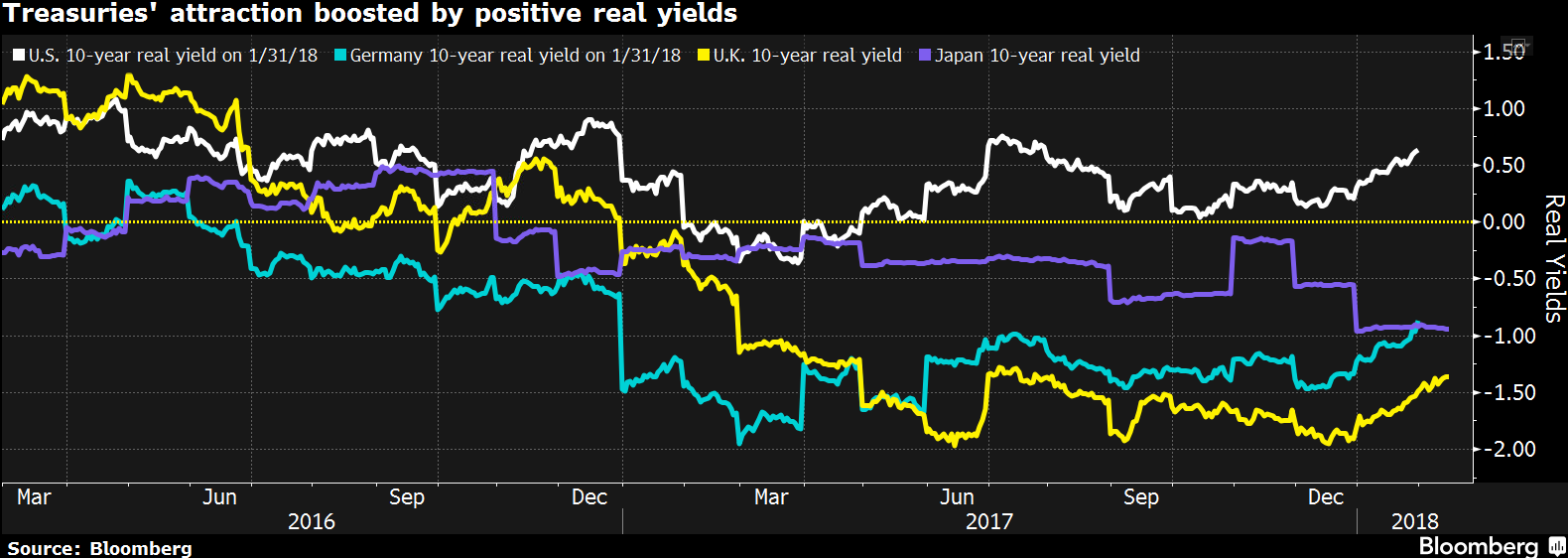

Real yields are still edging higher, and that's going to give incentive for portfolio managers to shift towards Treasuries as they get more and more attractive.

But in the meantime, the market is still flushed with liquidity - and that has been one of the prime catalysts for the bull run in equities over the past few years. It's more of a case of who blinks first now. Asian equities are posting solid gains on the day, as they got a green light from US stocks yesterday. They're looking across the table and see no reason to change the winning formula that has served equity traders well during this time - which is buy the dip.

Onto the FX space, the dollar being offered is a continuation of the recent trend. The correlation between higher yields boosting the dollar has been broken since mid-January, and you have to wonder at this point if anything is going to be able to push the dollar higher. Better-than-expected inflation readings yesterday provided a good case for 4 rate hikes, yet the dollar sank.

It's a shift in the trading paradigm, and it's one as traders we need to adjust to. It's still early days, as we're only in the second week of all the fun and games - and at this point anything still goes as the market tries to figure out the new "normal".

--