• Underlying economic momentum remains weak and is consistent with disinflation.

• Future fiscal policy is expected to lead to lower government spending and so doing support monetary policy

• The Q1 GDP data will be critical for the RBNZ in assessing domestic demand and inflation risks. Private consumption and various investment and spending indicators will be important to gauge underlying economic conditions.

• The weak economic backdrop suggests the RBNZ may cut the Official Cash Rate (OCR) sooner than previously signalled, with expectations for cuts starting in February 2025.

• GDP expected to expand by 0.2% quarter-on-quarter in Q1 2024, aligning with the RBNZ's May forecast, and annual growth rate is projected to be 0.3%.

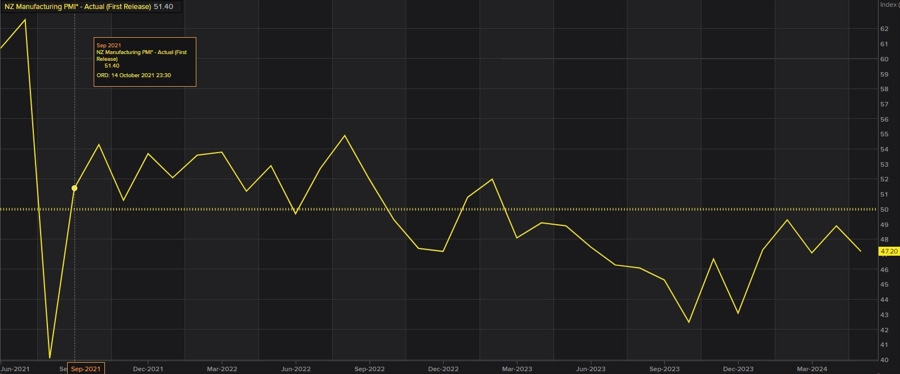

GDP is coming up next week so one to watch for the NZD traders. For reference, this morning's PMI data slowed to 47.2.