Fed fund futures are now showing roughly 59% odds of the central bank not raising interest rates in May. While that may seem a bit high, it is important to take things with context as that probability was seen at around 85% at the start of the week.

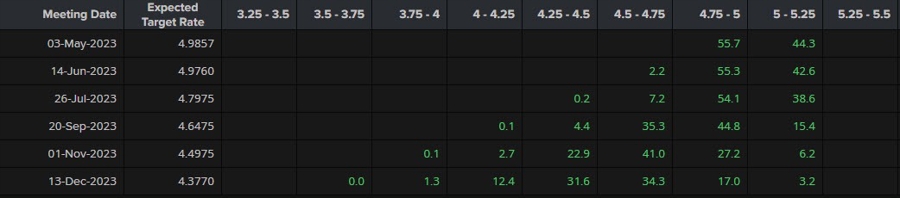

The fact that the banking turmoil is blowing over will definitely help the Fed's case or at least afford them more flexibility and that might be something that markets may end up having to race to price in moving forward. Here's a look at the curve for implied rates and the probability distribution via Fed fund futures:

It already reflects a peak in terms of the rates outlook, with rate cuts to come as soon the end of this year.

What does this all mean?

Essentially, market pricing is implying that the Fed is done in terms of the tightening cycle. However, if Powell & co. remains bold and steadfast in their resolve to take down inflation, it means we are likely to see markets have a rethink.

If the latter does play out, that would provide some tailwind for the dollar while perhaps weighing on equities (not only due to more rate hikes, but rising worries of another financial/economic hit) and bonds (rates will have to reprice higher) as well. That especially if we start to fall back in line with the notion of the "6% trade".

This theme will not be too evident from a day-to-day basis in markets but each time we get important and big economic data, this will be what drives the reaction in markets in the aftermath.