Flash readings are here:

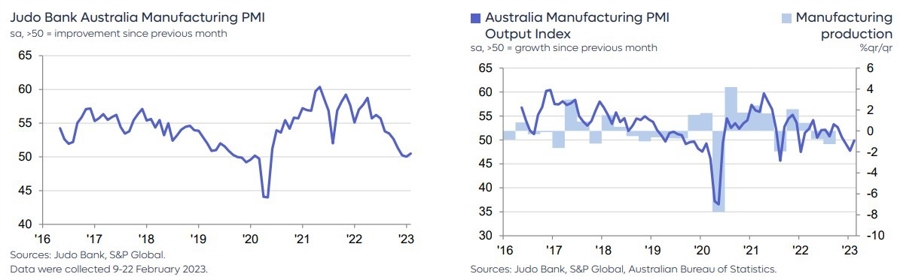

This is the Judo Bank / S&P Global PMI for Australia.

- Warren Hogan, Chief Economic Advisor at Judo Bank commentary on the result:

- “New exports orders are creeping higher from a relatively soft starting point. It is early days, but Australian manufacturers might be starting to see increased demand from international markets, particularly China where the re-opening of the domestic economy is set to give economic activity a kick upwards over the first half of 2023.

- “The latest Judo Bank Manufacturing PMI results suggests the Australian economy remains on track for a soft landing in 2023. None of the forward-looking indicators are pointing to recession. If anything, the recent stabilisation of the PMI and the output index suggests that the next shift in economic momentum for the Australian economy could just as easily be upwards as it could be for further slowing.

- “The demand for labour within the Australian manufacturing sector remains strong in early 2023. Despite the slowdown in activity over the past year, manufacturers are still looking to expand their workforces into what is an extremely tight labour market.

- “Price indicators also remain stubbornly elevated having stabilised at relatively high levels over the summer. The decline in input prices witnessed since the mid 2022 peak has all but come to an end over the three months to February 2023. Both input and output price indexes have stopped falling in any meaningful way. The current level of these indicators is consistent with overall inflation in Australia of around 4-5% in 2023, broadly in line with official forecasts.

- “The latest PMI results support the notion that Australian economic activity, after slowing down over the second half of 2022, is holding up in early 2023. Strong labour demand and elevated price indicators are consistent with a further modest increase in interest rates over the next six months.

- “We expect the RBA to increase the cash rate by 25bp at the March board meeting. Our central case forecast for the economy and interest rates assumes the RBA cash rate rising to between 4% and 4.5% later this year.”