This is via the folks at eFX.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

- Bank of America Global Research discusses its base-case for cross assets outlook in 2023.

- "Lower rates, weaker USD and stronger EM is the building consensus for 2023. This is our base case too but with higher confidence after 1Q. We are more convinced of a China reopening pivot than DM policy pivot, but optimism surrounding both may fade near term. Meanwhile, the global economy continues run the risk of stagflation partly due to loose fiscal policy keeping central banks on a tightening path," BofA notes.

- "The technical outlook sees a choppy 1Q before rates & USD can establish a peak (and EM a trough)," BofA adds.

--

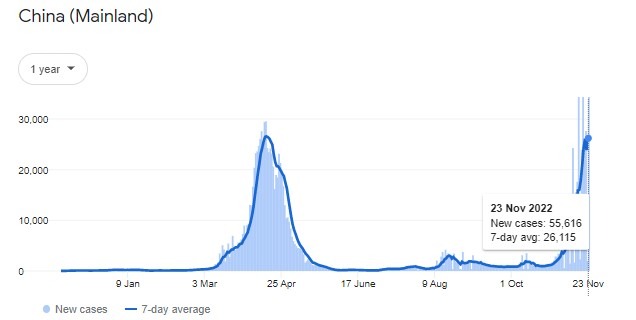

The China reopening is going to be delayed by the new record high case load:

Official Chinese data is always filtered through the Chinese Communist Party propaganda machine. For them to be putting their hands up to record high cases means its really, really bad there. We wish the Chinese people well in dealing with this nasty infection, and COVID.