CIBC highlights a mixed picture in today's Canadian retail sales report but emphasizes that any strength won't extend into 2024.

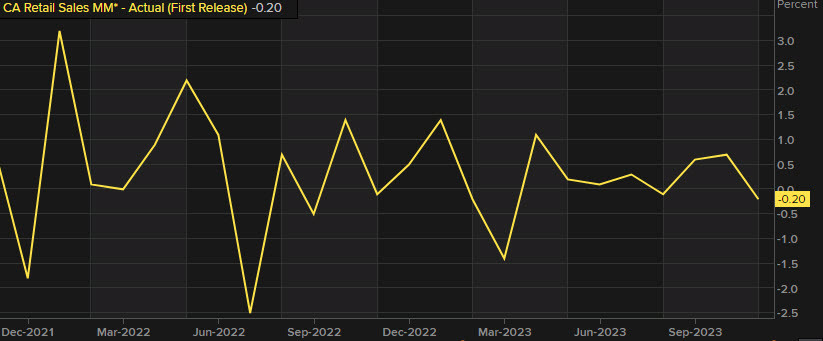

November Canadian retail sales fell 0.2% in November compared to 0.0% expected with sales ex-autos and gas down 0.6% following a 1.2% decline. The good news was that advance December sales were up 0.8%.

CIBC emphasizes that it's population growth in Canada driving sales, not consumer strength.

"Spending still looks worse in per-capita terms, as it sat 1.0% below year-ago levels as of November," economist Katherine Judge writes.

She notes that the weakness in November came from key discretionary areas, including online shopping and general merchandise stores, along with grocery stores. She also notes the drag from housing and the tailwind from autos.

"Sales in categories tied to housing market activity, namely furniture and building materials, showed modest growth in monthly volume terms, but are down by 4.4% and 1.1% in y/y terms. Supply chain normalization and the impact on the auto industry has been a theme for the year, and that was apparent in the November data, with sales volumes up by 0.3% m/m and 4.2% y/y."

Importantly, she sees the strength from Q4 retail sales reversing early in 2024.

"After consumer spending stagnated in the third quarter, it looks to have been a positive growth contributor in the fourth quarter. We don't expect the momentum to last, however, as survey evidence shows that consumers are becoming increasingly worried about job prospects and mortgage renewals, which will weigh on spending in early 2024."

USD/CAD is down 22 pips to 1.3465 today. I spoke with Reuters about the loonie yesterday.