- Prior was 5.2%

- CPI m/m +0.5% vs +0.5% expected

- Prior m/m reading was +0.4%

- Gasoline prices -13.8% vs -4.7% y/y in prior (largest decline since July 2020)

- Gasoline prices -1.2% m/m vs -13.1% prior

- Food +9.7% vs +10.6% y/y prior

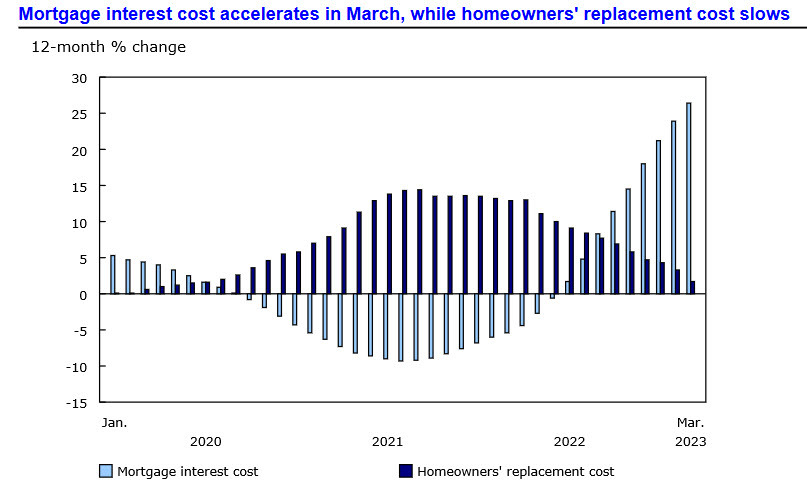

- Mortgage interest costs +26.4% y/y vs +23.9% prior

Core measures:

- BOC core y/y 4.3% vs 4.4% expected (4.7% prior)

- BOC core m/m +0.6% vs +0.5% prior

- Median 4.6% vs 4.9% prior

- Trim 4.4% vs 4.8% prior

- Common 5.9% vs 6.4% expected

Canadian yearly CPI has begun to fall rapidly as it hits the y/y comps from a year ago. The Bank of Canada last week forecast that inflation would fall to 3% this summer. What's a tad worrisome is that the latest m/m readings are still showing some heat with back-to-back numbers at +0.5% and +0.4%. Those aren't readings that will add up to 2% if they continued.

USD/CAD is little-moved after the release and down 17 pips to 1.3375 on the day.

CIBC notes that

"Travel tour costs posted their sharpest monthly gain on record (+36.7%) and provided the largest upward contribution to monthly CPI despite having a relatively small weight. The surge was likely driven by the timing of March break and pent-up demand for travel, and so could reverse in the coming months. Air transportation prices (+1.3%) were fairly muted in comparison."

Main contributors to the 1-month change, not seasonally adjusted

Main upward contributors (m/m %)

- Travel tours 36.7

- Mortgage interest cost 2.0

- Purchase of passenger vehicles 1.0

- Electricity 3.1

- Gasoline 1.2

Main downward contributors:

- Fresh vegetables -4.0

- Fuel oil and other fuels -10.3

- Fresh fruit -3.2

- Telephone services -1.6

- Natural gas -2.4

Doesn't this chart speak to the heart of central banking?