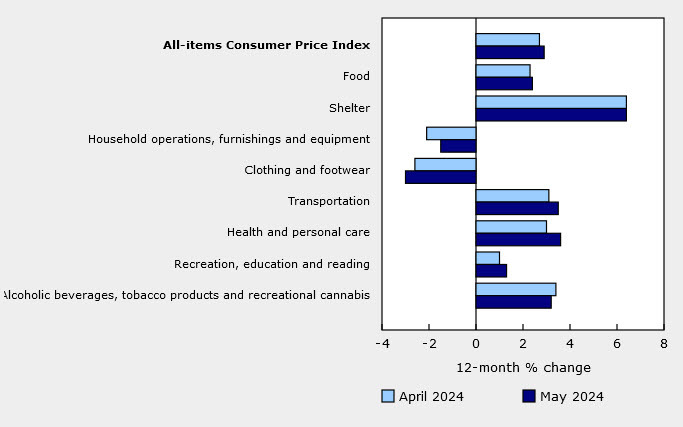

- Prior month 2.7%

- CPI m/m +0.6% vs +0.3% estimate

Core measures

- CPI Bank of Canada core y/y 1.8% vs 1.6% prior

- CPI Bank of Canada core m/m 0.6% versus 0.2% prior

- Core CPI m/m SA +0.3% vs 0.0% prior

- Trim 2.9% versus 2.8% prior

- Median 2.8% versus 2.6% prior

- Common 2.4% versus 2.6% prior

Bank of Canada July implied rate cut odds immediately fell to 52% from 71% on the CPI data. Acceleration in the headline CPI was largely due to higher prices for services, which rose 4.6% in May following a 4.2% increase in April. That tends to be stickier inflation and will certainly worry the BOC, though just yesterday Macklem was downplaying wage increases.

Within services, cell phone service, travel tours (+10.4% m/m), rent (+8.9% y/y) and air transport (+2.3%) were drivers. Cell phone plans have been dropping but a -7.8% m/m comp from May 2023 fell out of the index and that bumped up the y/y reading to -19.4% from -26.6%.

Prices for goods were up 1.0% y/y, the same as in April but grocery prices rose on a y/y basis for the first time since June 2023.

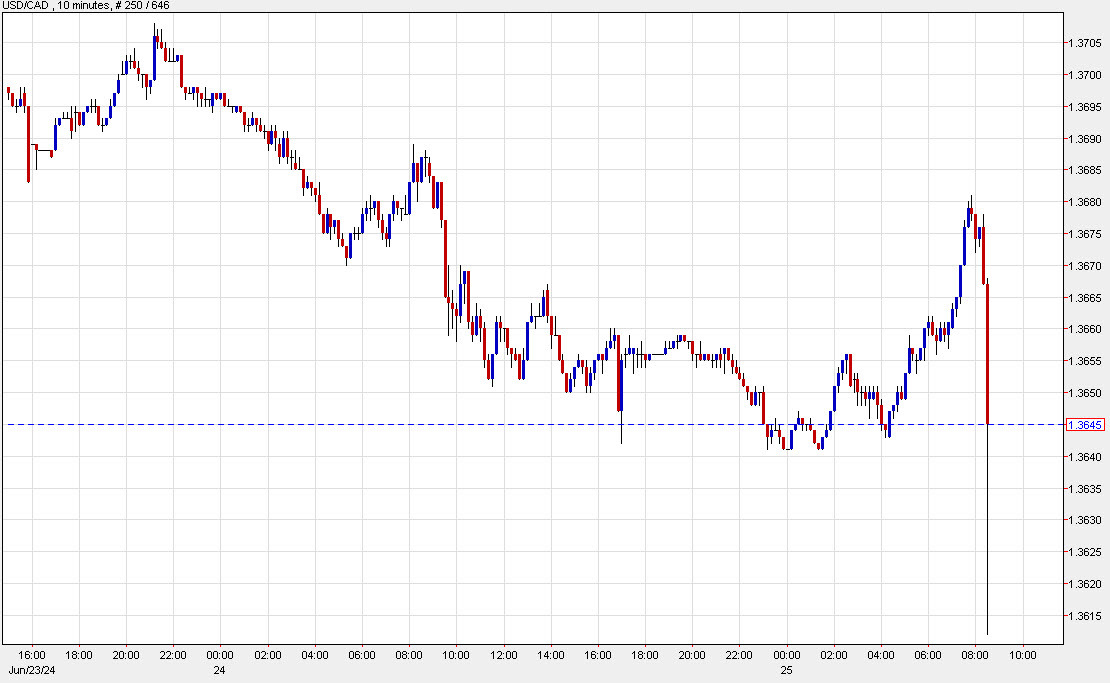

USD/CAD initially fell on the report but quickly recouped most of the losses. The natural reaction is for a currency to rise on a number like this but I wonder if the market is sensing economic pain in Canada and treating inflation as yesterday's story because of the recessionary clouds on the horizon.