- Prior was 6.9%

- CPI m/m +0.1% vs 0.0% expected

- Prior m/m reading was +0.7%

- Gasoline prices 13.7% vs +17.8% y/y in prior

- Gasoline prices -3.6% m/m vs +9.2% prior

- Food 11.4% vs +11.0% y/y prior

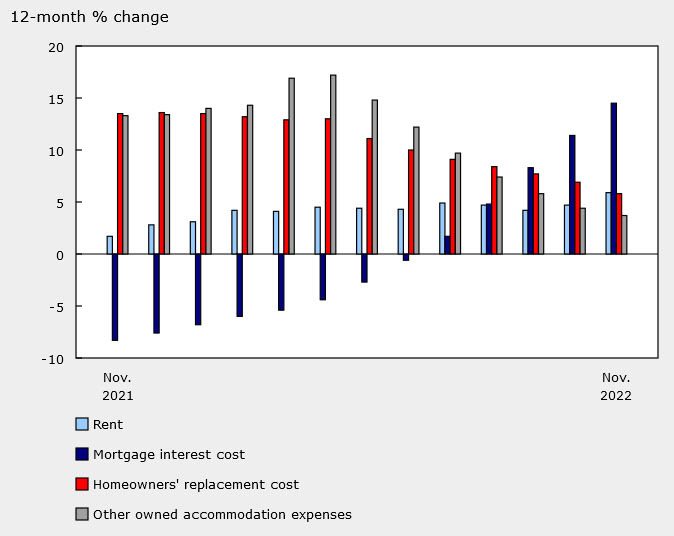

- Mortgage interest costs +14.5% vs +11.4% prior

Core measures:

- BOC core 5.8% vs 5.8% prior

- BOC core m/m 0.0% vs +0.4% prior

- Median 5.0% vs 4.8% prior (revised to +4.9%)

- Trim 5.3% vs 5.3% prior

- Common 6.7% vs 6.2% prior (revised to +6.4%)

The story here is the jump in mortgage interest costs, something that's been manufactured by the Bank of Canada to fight inflation .

Still, this report makes it more likely the Bank of Canada hikes again in January. Pricing right now is close to 50/50.

At the same time, I think what's left of the Canadian housing market is hanging on by a thread.