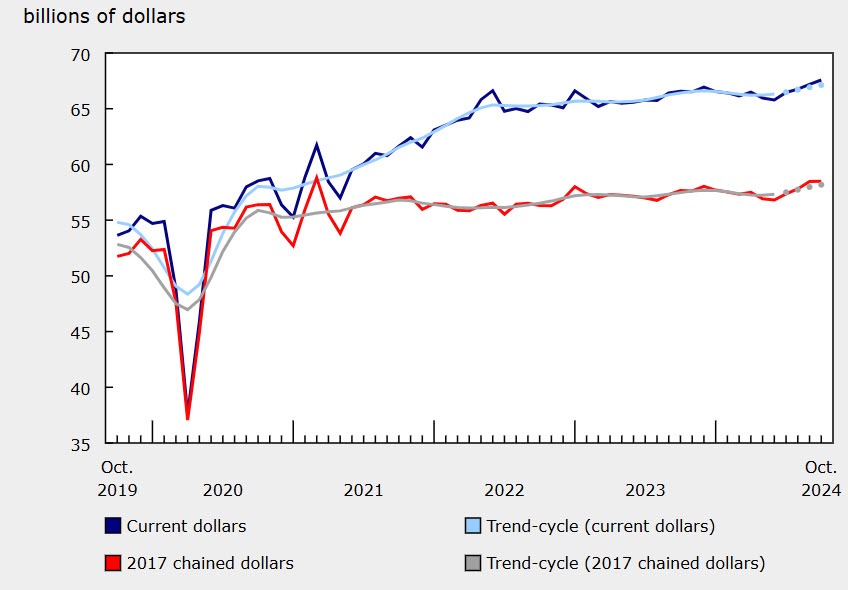

- Prior month 0.4% revised to 0.6%

- Canada retail sales 0.6% vs 0.7% expected

- ex Auto 0.1% versus 0.5% expected.

- Prior month ex auto revised higher to 1.1% from 0.9%

- Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were up 0.2% in October

- Sales were up in five of nine subsectors and were led by increases at motor vehicle and parts dealers

Looking at the details of the report:

- The largest increase in retail sales in October was observed at motor vehicle and parts dealers (+2.0%). Higher sales at new car dealers (+2.5%) led the increase, followed by used car dealers (+2.5%). Automotive parts, accessories and tire retailers (-3.3%) were the only store type within this subsector to record a decrease in October.

- Sales at gasoline stations and fuel vendors (-0.5%) were down for a sixth consecutive month in October. In volume terms, sales at gasoline stations and fuel vendors decreased 4.7%, following an increase of 4.1% in September.

The advanced report for November

- Advance estimate suggests retail sales were relatively unchanged in November.

- Figure is unofficial and subject to revision.

- Based on responses from 50.6% of surveyed companies.

- Average final survey response rate over the past year was 88.7%.

The data is a touch weaker than expectations but the priro month was revised higher too. However the ex Auto and the core were on the weak side.

For the USDCAD, it is reacting to the PCE data in the US which was a bit lower than expected.

Looking at the hourly chart, the price of the USDCAD has moved to a new low on the day . There is support near 1.4348 (swing high going back to March/April 2020). Below that, the rising 100 hour MA come in at 1.4337. That is also near the underside of a broken trend line on the hourly chart.