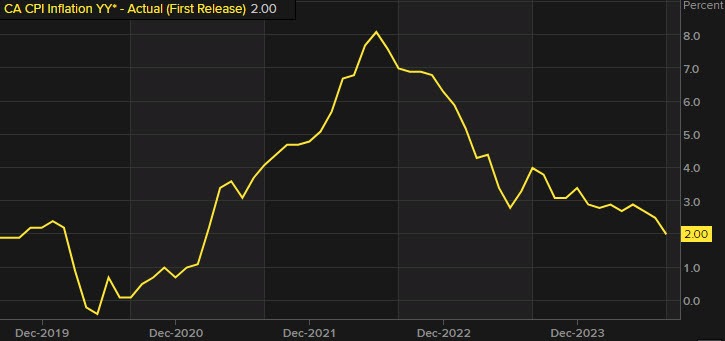

Canada CPI the lowest since March 2021

- Prior was 2.0%

- CPI m/m -0.4 vs -0.2% expected

- Prior m/m +0.4%

Core measures

- CPI Bank of Canada core y/y 1.6% vs 1.5% prior

- CPI Bank of Canada core m/m 0.0% versus -0.1% prior

- Core CPI m/m SA +0.1% vs +0.1% prior (revised to +0.2%)

- Median 2.3% versus 2.3% prior

- Trim 2.4% versus 2.5% prior

- Common 2.1% versus 2.0% prior

This really firms up the case for the Bank of Canada to cut by 50 basis points on October 23. USD/CAD is at the highs of the day and on track for a tenth straight day of gains.

On the report, CIBC notes that: Excluding mortgage interest costs, which are still picking up the effects of past interest rate hikes (and which most countries exclude from their inflation targets) CPI would have been a mere 1.0% year-over-year in September