In a surprising twist, the US retail sales for August have left market expectations in the dust, showcasing a resilient consumer base keen to keep the summer spending vibe rolling. But CIBC hints that the party might not last long. Here’s what you need to know.

Key Highlights:

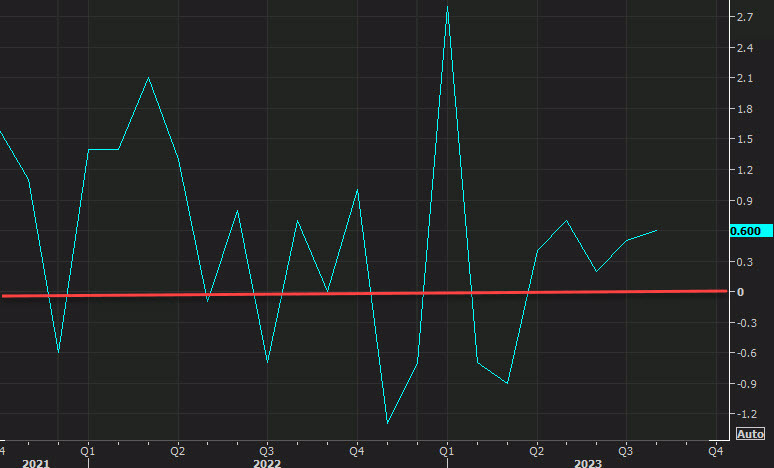

Beating the Odds: Despite consensus expecting a modest 0.1% month-on-month rise, August retail sales grew at a robust 0.6%. Even the control group, a critical component affecting GDP, showed a 0.1% uptick versus an anticipated dip.

Mixed Bag in Categories: While online spending held steady, interest-sensitive sectors like furniture, electronics, and vehicles displayed a colorful patchwork of gains and declines.

A Closer Look at Real Spending: Paired with recent CPI data, real spending has remained stable, albeit slightly on the lower side.

Cautious Optimism: CIBC forecasts a cooling in consumer exuberance as the leaves turn, pointing to drained excess savings, looming student loan repayments, and dwindling labor income growth as potential party-poopers.

Investment Tips:

Consumer Stocks: Tread Carefully: Now might be a good time to reassess your exposure to consumer-oriented sectors.

Eye on Interest Rates: With mixed results in interest-rate-sensitive sectors, keep a vigilant eye on upcoming rate decisions.

What This Means:

For Day Traders:

Ride the Wave: Retail’s surprise uptick may offer short-term wins, particularly in sectors that have seen an uptick in spending.

Look Ahead: Be mindful of potential headwinds as consumer spending could lose steam come fall.

For Policy Watchers:

- Economic Signals: The strong retail numbers indicate underlying consumer strength but should be interpreted cautiously given upcoming economic pressures.

Excited yet? Keep an eye out, because as the seasons change, so could the fortunes of the American consumer.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.