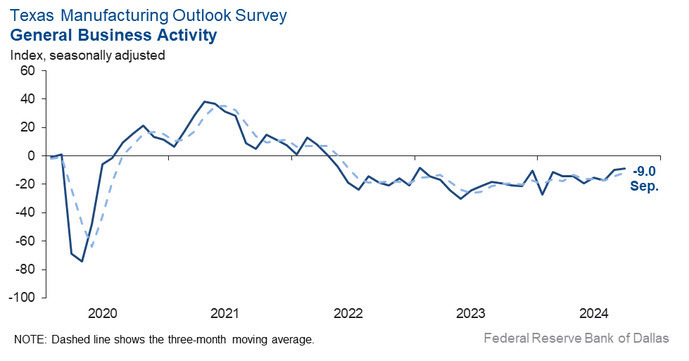

- Prior was -9.0

- Output (production) +14.6 vs -3.2 prior

- New orders -3.7 vs -5.2 prior

- Employment -5.1 vs +2.9 prior

- Outlook -3.3 vs -6.4 prior

- Prices paid for raw materials +16.3 vs +18.2 prior

- Prices received +7.4 vs +8.4 prior

- Wages +23.5 vs +18.5 prior

Comments in the report:

Chemical manufacturing

- Interest rate impacts continue to put pressure on the overall construction markets and auto industry, which are major customers of the basic materials space.

- Chinese producers are selling chemicals products at prices that are, in some cases, lower than our production costs in the U.S.

Computer and electronic product manufacturing

- We need more interest rate cuts on leasing capital equipment to see a difference in our industry. Rates are still too high.

Fabricated metal product manufacturing

- We are expecting a continued period of lower demand and production over the next six to 12 months. We have flexed down our workforce and supplier purchases accordingly.

Food manufacturing

- We are experiencing inflation-related increases in the cost of doing business across the spectrum of operations with no real way to recoup or have margin protection.

- Sales volume is below projections for fourth quarter 2024. Geopolitical instability is increasing throughout the world, and the U.S. presidential election may create more instability.

- We are seeing increased demand for our products, which is driving the increase in our production.

Furniture and related product manufacturing

- We have continuous problems with homeless encampments and property damage at our business location. The city of Dallas holds property owners responsible for cleaning up encampment sites, which are gone one day and back the next. We have to start the entire process over again. This is definitely time wasted for productivity as we have to use our own employees to clean up the sites.

Machinery manufacturing

- Business remains slow; however, we are hopeful that after the election, business will pick up (if the "right" candidate wins).

- Geopolitical conflict and aggression wreaks havoc with our planning. Our own election outcome cannot be known soon enough. We have prospective deals of significance on hold pending who takes office. Overall, it's been a really rough year through no apparent fault of our own, but our pivots have yet to yield favorable results despite being as nimble as possible. Hopefully, 2025 will be a year of jubilation!

Miscellaneous manufacturing

- A prominent slowing of business began in October 2023, and it has continued to trend lower month over month for the last 12 months.

- We are looking forward to some unity in the country and getting past the election and back to business. We need interest rates to come down and stay low for planning 2025, otherwise we will be having a challenging environment next year.

Paper manufacturing

- Orders and the outlook are trending down at the time.

Primary metal manufacturing

- We are investing in plant, equipment and processes to add new product offerings to improve business conditions.

Printing and related support activities

- We are now in month two of much slower business activity, something we have avoided for the previous 10 months. Hopefully, things will pick up soon, or else we will need to reduce head count in the plant. Naturally, this comes just as a huge capital expenditure machine has arrived and is in the process of being installed and training beginning.

Textile product mills

- We've had a strong October across all buying sectors, which makes us feel better about the short-term market. Long-term uncertainty is still high and unchanged; we've heard there's a lot of uncertainty with the election and a potential East Coast dock strike.

Transportation equipment manufacturing

- Our outlook is predicated on the election outcome.