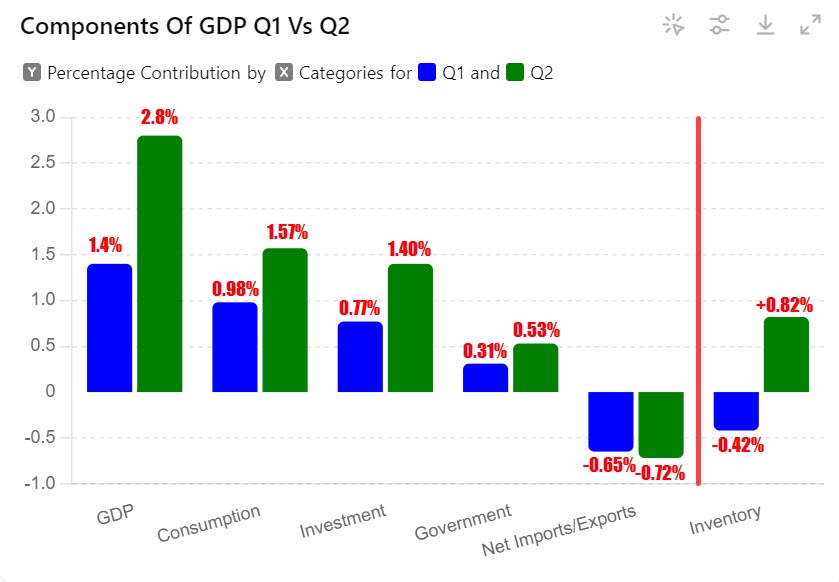

The GDP data in the Q1 came in at 1.4%. Today we learned the advanced GDP for Q2 came in at 2.8%.

If you looked at the component contributors or subtractions from the total GDP number:

For Q1:

- Consumption +0.92%.

- Investment, +0.77%

- Government, +0.31%

- Net imports/exports -0.65%

The sum comes to the GDP of 1.4%

For Q2:

- Consumption, +1.57%.

- Investment, +1.40%.

- Government, +0.53%.

- Net imports/exports, -0.72%

The sum of those components comes to GDP of 2.8%

Now, within the investment component is inventory. Inventories can fluctuate up and down and indeed they did swing from a negative contributor in Q1 (-0.42%) to a positive contributor (+0.82%) in Q2.

What if the GDP numbers for each was adjusted for the inventory swings?

Inventories in the Q1 subtracted -0.42% from the GDP. If that is added back, the growth ex inventories comes at around 1.8% in Q1.

For Q2, if you were to subtract the inventory gain of 0.82% from the total 2.8% gain, the GDP would be just below 2.00%

So combining the two quarters GDP ex the inventory, the growth comes in around 1.9% which is about the trend growth.

Soft landing?

The Fed may look at it that way vs the Q2 is twice as strong.