- US equities go for a ride. Heavy late buying saves the day

- US regional banks start hot, end cold

- WTI crude settles at the lows of the year. The chart is daunting

- Fed likely to tighten another 25 bps - report

- Don't bank on it: Global bank stocks slump

- Russian fighter clips US drone propellor of the Black Sea, causes crash landing

- Regional banks crisis a strong indication Fed's cycle coming to an end; bearish USD - MUFG

- The Fed has never cut rates when unemployment is this low

- Cleveland Fed median CPI +0.6% m/m vs +0.7% prior

- Yields are up, but they are down more. Confused?

- The most-important thing in the past 24 hours is what didn't happen

- Bitcoin screams to a nine-month high in an impressive rally

- Canada manufacturing sales for January 4.1% versus 3.9% expected

- US February CPI 6.0% y/y vs 6.0% expected

- Signs that the squeeze was on yesterday. CPI up next

- The CAD is the strongest and the JPY is the weakest as the NA session begins

- ForexLive European FX news wrap: The bond market swings continue, US CPI data up next

Recall on Friday, the US unemployment statistics had a muted impact on markets, despite a 311K increase in Non-farm payrolls. Yields moved sharply lowe on the back of the shuttering of Silicon Valley Bank.

Today's US CPI release also received a subdued response from market traders. The month-on-month CPI rose by 0.4% and 6.0% year-on-year, while the core CPI (excluding food and energy) increased by 0.5% monthly and 5.5% annually. Both headline and core measures came close to or met expectations, yet remained significantly above the Federal Reserve's 2% target.

However, traders seemed unfazed by these figures, as expectations for rate hikes have diminished in light of recent regional bank failures. The lagging impact of the Fed's aggressive actions over the past year has taken a toll on the economy and has it screaming "uncle" (i.e., we've had enough).

Market expectations last week were for a 50 basis point hike at the March 22 meeting. Those expectations have plummeted, with the Fed rate outlook for April now at 4.79%. That prices in a 16 basis point hike for March 22, from the current Fed target of 4.63% (Fed target now is between 4.5% and 4.75%), The terminal rate expected in May, has also dropped sharply to 4.96% (from nearly 5.75% a week ago).

Moreover, traders anticipate that by January 2024, the Fed rate target will be around 4.46%, suggesting a potential rate cut of 50 bps.

US stocks gained from this repricing, with major indices rallying by the end of the trading day:

- Dow Industrial Average: +1.06%

- S&P Index: +1.68%

- NASDAQ Index: +2.14%

- Small-cap Russell 2000: +1.87%

In the interest rate market, the two-year yield rose by approximately 26 basis points, marking the largest increase since August 2022. However, the current 4.25% level has led traders to believe that the Fed's tightening path might have reached its limit. Just last Wednesday, the two-year yield peaked at 5.085%. Meanwhile, the US 10-year yield stands at 3.693%, up 13 basis points today and down from last week's high of 4.089%.

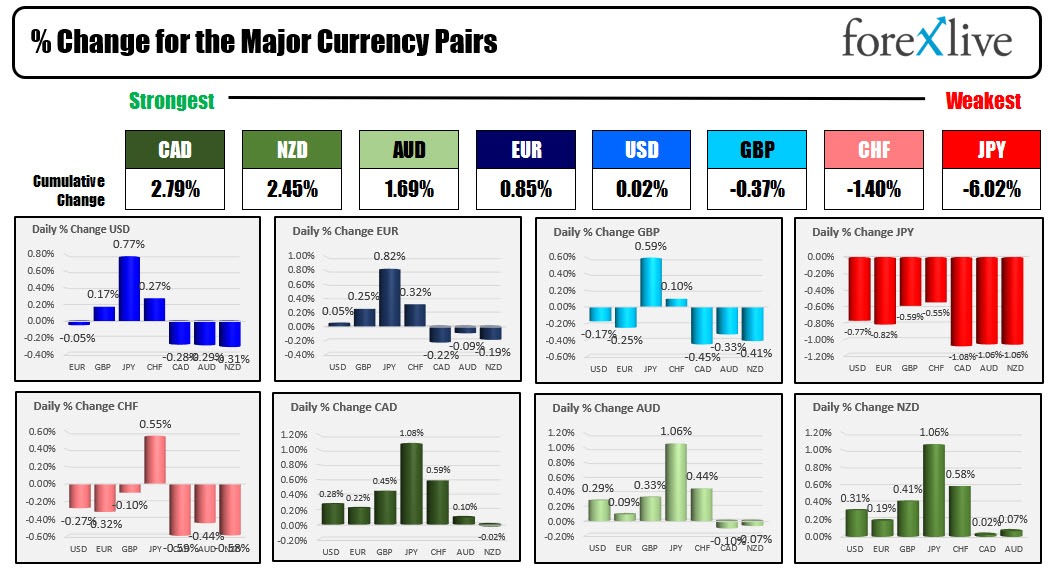

In the forex market, the CAD emerged as the strongest major currency, followed closely by the NZD and AUD (due to risk-on flows). The JPY was the weakest. The US dollar ended the day mixed, gaining 0.77% against the JPY but declining by -0.28% to -0.31% against the CAD, NZD, and AUD.

In other markets today:

- Spot gold: down -$8.67 or -0.45% at $1,904.01

- Spot silver: down -11.7 cents or -0.54% at $21.65

- WTI crude oil: down -$3.33 at $71.47, reaching the lowest level since December 12 at $70.78

- Bitcoin: rose to $26,533 (the highest level since June 13, 2022), but retreated to $24,555 by the close. At the close, the price is back below the year's previous high of $25,270.