- Fed's Barkin: 'Very encouraging' inflation news over the past three months

- WTI crude futures settled above $80 at $80.18

- The best chart I've seen lately on global house price risks

- New Zealand median house prices -12.1% y/y in December - REINZ

- With the Bank of Japan ahead, what don't the USDJPY sellers want to see technically

- Top US banking official warns overcomplexity could force breakup of largest banks

- Why the best trade is to be long JPY into the BOJ - Deutsche Bank

- European equity close: ECB sources keep gains on track

- This is a scary chart for China

- Italian 10-year yields sink after ECB sources report suggests fewer hikes

- ECB sources: 50 bps at the next meeting and then 25 bps afterwards?

- Goldman Sachs warns on early signs of deterioration

- New Zealand GDT price index -0.1%

- The morning forex technical report for January 17, 2023

- Empire manufacturing index for January -32.9 vs -9.00 estimate

- Canada December CPI 6.3% y/y vs 6.4% y/y expected

- OPEC leaves 2023 world oil demand forecast unchanged

- Canadian December housing starts 248.6K vs 257.5K expected

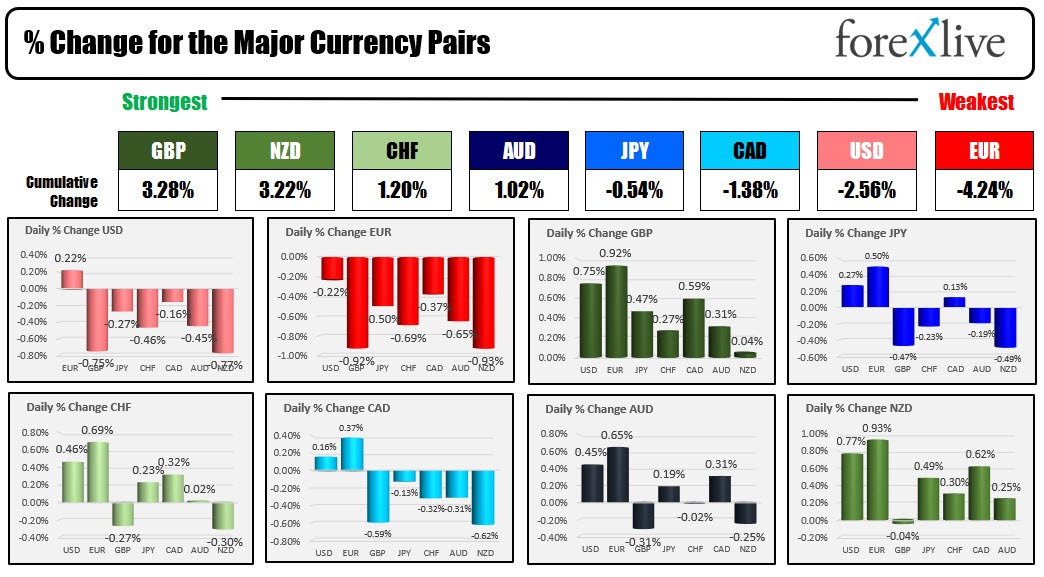

- The GBP is the strongest and the JPY is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar mixed ahead of Wall Street return

The EUR was the weakest of the majors today, helped by an ECB sources headline saying that the policymakers were mulling a slower pace of hikes with 50 basis points at the next meeting but a slower pace after that. The policy is in contrast to the December meeting where Lagarde got on the hawkish soapbox leaning toward additional 50 basis point hikes going forward. The bearish tilt was said to appease those that wanted a 75 basis point hike at the last meeting.

Go figure.

The headline, turned the EURs fortunes around. Just prior to the announcement, the EURUSD was trading near the high for the day (and near the 4-day high as well - near 1.0863). The price reversed lower, and within an hour, the price crossed below the Asian session low at 1.0805 and the 100 hour MA (at 1.0815 currently). The low price for the day targeted the swing highs from last Thursday and for the first half of a Friday near 1.0775. Support buyers stalled the fall, and the price consolidated the declines, but remained below the 100 hour MA at 1.0815. Going into the new day, the 100 hour moving average will be close resistance. Stay below keeps the sellers in control.

The EURUSD was down, but it is ending as the best performer of the EUR pairs (-0.22%). The EURNZD is down -0.93%, the EURGBP is down -0.92% and the EURCHF is down -0.69% near the close for the day.

The strongest currency for the day was the GBP which saw the GBPUSD move to the highest level since December 15. The price of the GBPUSD tested the 50% midpoint of the move down from the June 2021 high at 1.23006. The high price reached 1.22994 just below that natural and technical resistance target.

The USD was mostly lower today helped by news that the Empire manufacturing index tumbled to -32.9 vs -9.0 estimate (and -11.2 last month). The surprise fall, put the dollar on the back foot against most currencies with the exception of the EUR. The USD fell -0.77% vs the NZD and -0.75% vs the GBP today.

In the new trading day, the BOJ will meet and decide what it might do to help slow its creeping inflation rate. The JPY moved up by 0.27% vs the USD and 0.5% vs the EUR, but was down vs the GBP (-0.47%) and NZD (-0.49%). Going into the decision, the USDJPY has technical resistance above near the falling 100 hour MA at 129.125 and a swing low from January 3 at 129.497. That area between 129.125 and 129.497 would need to keep a lid on the pair, if the sellers are to remain in full control through the central bank's decision. Move above, and the buyers take back some control.

IN other markets today, the US stocks closed mixed with the Dow under pressure. The S&P was marginally lower but the Nasdaq closed higher.

The Dow was hurt by disappointing earnings from Goldman Sachs (-6.46%) and Travelers (-4.69% - Travelers pre-announced a miss). Verizon, 3M, Dow and Honeywell all fell more than 2% on the day contributing to the Dow Industrial Average's fall of -1.14%.

The S&P index snapped a 4 day win streak with a decline of -0.20%. Although lower, the price did close above its 200 day MA at 3978.17 for the 2nd consecutive day.

The Nasdaq kept its win streak alive. It has now closed higher on 7 consecutive days, but the 0.14% rise was nothing to write home about. Nevertheless, the string remains intact - albeit at a slower pace.

- Spot gold fell -$8.88 despite the fall in the USD today

- Spot silver fell -$0.37 or -1.54% at $23.91

- Crude oil is up for the 8th day in a row. It is trading at $81.00

- Bitcoin is higher on the day by about $120 at $21310. The digital currency opened the new year at $16530.

In the US debt market, yields are closing mixed with a steeper curve:

- 2 year 4.204%, -3.6 bps

- 5 year 3.588%, +2.4 bps

- 10 year 3.549%, +3.8 bps

- 30 year 3.660%, +3.8 bps