- Big closing gains for stocks as Powell rides to the rescue

- VIDEO: Soft landing? Happy days are here again. A look at the markets post Powell speech.

- How will China reopening affect global inflation?

- Christmas comes early for stock markets as Powell says he doesn't want to overtighten

- Beige Book: Economic activity was about flat or up slightly since the previous report

- Powell Q&A: Slowing down at this point is a good way to balance risks

- Fed Powell: Makes sense to moderate pace of interest rate hikes

- More from Fed's Cook: Important to be cautious about interpreting yield curve inversion

- More from Fed's Gov Cook:Service inflation is not yet slowed. Goods inflation is improving

- Feds Cook: Inflation is still too high. Main focus is on lowering px pressures.

- OPEC output fell 710k bpd in November - report

- The European indices end the day higher

- US dollar gains fade after the London fix

- Rising yields and month-end help to underpin US dollar bid

- EIA weekly US oil inventories -12,580K vs -2758K expected

- Russia oil price cap will be between $60-63/barrel - report

- US pending home sales for October -4.6% vs -5.0% estimate

- US JOLTS job openings 10.33m vs 10.3m expected

- US Treasury Secretary Yellen: Crypto needs adequate regulation

- What's priced into the Fed funds market ahead of Powell's speech

- US October wholesale inventories +0.8% vs +0.6% prior

- US advanced goods trade balance for October $-99 billion versus -$91.90 billion last month

- US Q3 GDP (second estimate) +2.9% vs +2.7% expected

- US ADP November employment +127K vs +200K expected

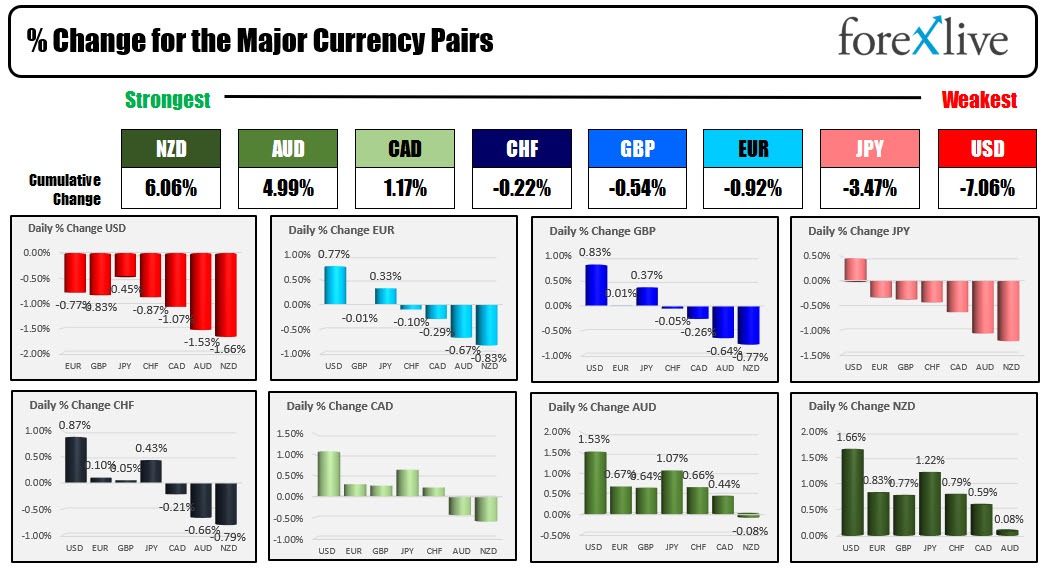

- The AUD is the strongest and the JPY is the weakest as the NA session begins

The market was focused on the Fed Powell today. Would he soften up his post FOMC comments and provide the market a reason to start a lower dollar ---> higher stocks--> lower yields-->even lower dollar-->even higher stocks --> and even lower yields cycle? That is the cycle for the "risk on" traders and the answer to that question was a resounding "YES!"

Comments about a "slower pace" of hikes was nice, but it seemed the markets really got going when he started to use the words "soft landing". He sounded like he believed it too. Maybe he got too into the moment, but the run higher in the stocks was good enough to push the S&P above its 200 day MA at 4050 (closed at 4080). That was the first close above the 200 day MA since back in April. The Nasdaq which has had more of a lid on the rallies, is approaching its 100 day MA at 11498.65. The price closed at 11468.01. Moving above and closing above would be more bullish and have traders targeting the 200 day MA next at 12053.05 (has not closed above since January 2021).

Although ex Fed member Randy Krosner said on CNBC, the Fed Chair's hopes were more like an "immaculate disinflation" prayer, where the Fed pushes inflation down without employment going higher, the markets liked the idea to the tune of gains of 2.18% in the Dow, 3.10% in the S&P and 4.41% in the Nasdaq.

In the US debt market, the 2 year yield fell -14.6 basis points. The 10 year fell -12.6 basis points and the 30 year fell -5.8 basis points.

In the forex market, the US dollar moved lower with the dollar index (DXY) approaching its key 200 hour MA at 105.47 (trades at 106.00 into the close for the day). A move below that MA would be its first since June of 2021.

.

The USD was the runaway weakest of the majors, while the risk-on NZD and the AUD were the big gainers on the day (see rankings below).

Now markets may be premature. The Fed Chair immaculate disinflation dream may be just that....a dream. However, the ADP employment report today came in weaker than expectations at 127K. The US jobs report will be released after two sleeps on Friday with expectations of 200K The 3 month average of NFP gains is down to 289K from around 600K at the start of the year (see the weekend video here).

A weaker number would give traders more visions of sugar plums dancing in their heads as we turn the page from November into the night before Christmas month.

It's ok to dream.