- US stocks trade to session highs

- WTI crude oil futures settle at $81.22

- U.S. Treasury auctions all $52 billion of 3 year notes at a high yield of 1.237%

- Powell's renomination hearing is concluded

- European shares close higher with all major indices moving solidly higher

- WTI crude blasts through $80

- US dollar sags as Powell speaks

- Fed's Powell: This year we will be moving to a policy closer to normal

- Evidence mounts that China omicron outbreak is spreading uncontrollably

- World Bank cuts 2022 global GDP growth forecast to 4.1% from 4.3%

- Fed's George: Will be appropraite to move earlier on shrinking balance sheet

- Fed's Mester: Would support a rate hike in March if economy remains on track

- The CAD is the strongest and the JPY is the weakest as NA traders enter for the day

- ForexLive European FX news wrap: Yen on the backfoot as stocks advance

The economic calendar was like today. However, Fed chair Powell was due testify on his renomination as Fed chair to the Senate Banking Committee. The expectations are that he will have bipartisan support, but the market was interested in hearing his take on the latest fear from the market. That is reducing the Fed's balance sheet.

Recall from last week's Fed minutes, they indicated that the Fed was not only looking to speed up taper, tight more aggressively in 2022 (3 times), but also looking to reduce the Fed's balance sheet which is close to $9 trillion.

The question traders mind is will that be through the natural maturing of the instruments without replacing them with an equal amount of purchases, OR via the maturing and outright sale out the curve. With a $9 trillion balance sheet, that leads a lot of uncertainty.

The Fed chair initially said that this year would see the Fed move policy back toward more normal. Specifically he said:

- This year I expect the Fed will raise rates, end asset purchases and perhaps later this year allow the balance sheet to shrink

The "perhaps" part caught the market a bit by surprise as it was expecting something little bit more concrete. Later, the Fed chair qualified that statement by saying:

- It will take 2-4 meetings to work through balance sheet decision

The 4th meeting would be the mid-June meeting. So, although the balance sheet reduction is not going to coincide with March most likely, it could still be in 1st half of 2022. Also unknown at this time (TBD), whether it is a runoff, or the more aggressive quantitative tightening (QT) is unknown until the Fed debates the move over the next few meetings.

Whether sooner or later, the market is getting more comfortable (at least today) with the idea. Also, true to Powell's modus operandi, changes will happen with ample warning, be fully transparent, and be methodical in the implementation.

Having said that, as evidence from the taper speed up and the expectations for 3 tightenings (going on 4) for 2022, it does not mean the Fed will not change their minds given economic circumstances.

The implications for the market today were:

- Stocks moved higher.

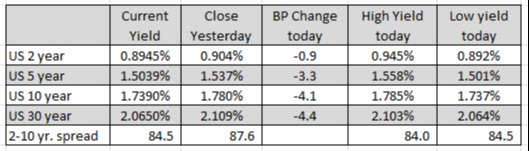

- Interest rates moved lower

- The dollar moved lower

- Oil and gold moved higher.

For the stock market, all the major indices closed near highs. The Dow snapped a 4 day losing streak. The S&P snapped a 6 day losing streak and the Nasdaq which was down 5 or 6 days, is ending with a 2 day win streak (after yesterday's small gain). The final numbers are showing:

- Dow up 183.15 points or 0.51% at 36252.03

- S&P up 42.8 points or 0.92% at 4713.08

- Nasdaq up 210.63 points or 1.41% at 15153.46

- Russell 2000 up 22.85 points or 1.05% at 2194.00

In the US debt market, the 10 and 30 year issues are ending down over 4 basis points on the day. The US treasury successfully auctioned off $52B of 3-year notes to strong demand from overseas purchasers after the runup of nearly 24 basis points over the last month. The US treasury will auction 10 and 30 year issues over the next 2-days.

Looking at the strongest to weakest currencies in the forex, the CAD is the strongest (oil prices are up near 3.7% on the day helping the loonie), and the JPY is the weakest. The USD is also weaker on the the day with only a modest gain vs the JPY keeping it from being in the red vs all the major currencies.

In other markets, near the 5 pm close:

- Spot gold is up $20.84 on the dollar weakness at $1821.47

- Spot silver is also up solidly with a $0.33 gain or 1.44% at $22.76

- Crude oil is up $3.03 in late after settle trading or 3.87% at $81.26

- Bitcoin is also higher at $42718 after trading as low as $41284 at the session lows (and below $40,000 during yesterday's trading).