- US major indices snap a three day losing streak

- Biden: Invasion remains distinctly possible

- Some of the geopolitical premium comes out of oil. How much is left?

- ECBs Villeroy: We will retain our full optionality about pace of normalization

- European major indices close higher in the day

- Sen. Toomey: Senate Banking Committee should not proceed with vote on Fed nominee Raskin

- Russian foreign minister Lavrov: Blinken's aggressive rhetoric was unacceptable

- Republicans could boycott today's Fed confirmation hearing

- Top US and Russian diplomats holding call now - State Dept

- WTI crude decline exceeds $4 but rumbles about trouble in Dontsk continue

- New Zealand GDT price index +4.2%

- Scholz: NATO Eastern expansion is not on the agenda currently

- Putin: Decision on partial troop withdrawal has been taken

- Germany's Scholz says it's a good sign that Russia has withdrawn some troops

- Putin: We are ready to continue talks on missiles and other issues

- Canadian home prices up record 28% y/y in January - CREA

- US January PPI +9.7% y/y vs +9.1% expected

- Empire Fed manufacturing index for February 2022 3.1 versus 11.9 estimate

- Canada January housing starts 230.8K vs 245K expected

- The EUR is the strongest and the JPY is the weakest as the NA session begins

Reports are that there has been a retreat of some 10K of troops from the Russia/Ukraine border. That is some of what Pres. Biden said was 150K along the border. Whether the numbers are accurate or not, there appeared to be some sort of retreat.

Moreover, there was a meeting between German Chancellor Scholz and Putin (which may have led to the decision to withdraw some troops) which is encouraging in that diplomacy has a potential vs a military or a sanction response. It also gets Germany/Europe talking to Russia vs US talking to Russia. Nevertheless, expect both side continue to use their respective tactics (including the US) to get their points across. I am not sure that Russia will suddenly withdraw 150K troops and the militia weaponry that accompanies those troops. However, the risks seem less than they were just 4 days ago (Friday) when reports were of an imminent attack that would involve all sorts of military action (he'll probably invade tonight).

The actions was instrumental in a new market tone in the various financial markets.

In the European and US stock markets, the major indices all moved up by 1% o 2.5%. The Nasdaq and Russell 2000 led the way in the US (they are down the most from all -time highs too). The Italy's FTSE MIB and German Dax led the way in the European markets.

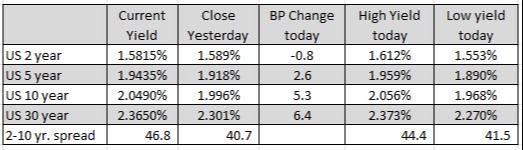

In the US debt market, the yields moved back higher - especially out the curve - as traders exited the flight to safety trade along with the yield curve flattening trade.

In the forex, the EUR benefitted from the ebbing of the war risk on their eastern bank. The AUD and NZD also benefitted from risk- on flows. The safe currencies (CHF and JPY) along with the USD were the weaker of the majors today.

The USD moved lower despite higher than expected PPI. The Fed and rate policy took more of a backseat to the developments from the Russia/Ukraine issues.

Looking at some of the major currencies:

- EURUSD : The EURUSD is closing near the highs for the day. The high reached 1.1368. The current price is at 1.1358. The pair stalled within a swing area between 1.1359 and 1.1368. The falling 100 hour MA is just above the high of that swing area at 1.1372. In the new day, that area would need to be broken to increase the bullish bias. The 100 day MA and 200 hour MA are both near 1.1405 which would be the next major target on more upside momentum. If resistance holds around 1.1368 area, there is support near 1.1330 (low from Friday and from Feb 2).

- GBPUSD : The GBPUSD had two failed breaks today - one to the upside and one to the downside. On the topside, the pair moved above the 100/200 hour MA and the 50% retracement targets between 1.3548 to 1.35526. The price moved up to 1.3566 in the early European session, before failing and then moving down to test the 100 day MA and a swing area between 1.3489 to 1.3501. The low reached 1.34858 before rotating back higher. The pair is ending the session near the high at 1.3535. Getting outside one of the technical targets (either above 1.3552 or below 1.3501) would likely lead to more momentum in the direction of the break.

- USDJPY: The USDJPY is closing higher and in the process, has moved above a swing area that helped define an upper extreme in 2022 between 115.53 and 115.68. That swing area defined resistance ahead of the highs for the year at 116.33 from Jan 4 and more recently Feb 10. The price moved to a high of 115.738 before coming off in the NY afternoon session and closing in the aforementioned swing area at 116.52. If the price can get back above 115.68 in the new trading day, there is hope for more upside momentum in the new trading day. Absent that and a move back toward the rising 200 hour MA at 115.443 will be eyed. Break below that MA and the sellers should get more serious.

In other markets:

- Spot gold is down -$17.87 or -0.94% at $1853.27 but before moving lower traded to the highest level since June 2021 at $1879.50. The low extended to $1844.61

- Crude oil traded as high as $95.17 today which was short of the newest 7 year high of $95.82 reached during yesterday's trading. The low was down to $90.66 today before closing the day near $91.94. The move lower today did see the price move back below the 200 hour MA currently at $91.19 but like the other dips in February, has not been able to extend far below the technical level.