- It is month end? How did the USD do vs the major currencies?

- US stocks close the month with strong gains

- EURUSD will go into next week within the same confined trading range

- WTI crude oil futures settle at $98.60

- Key events and releases next week highlighted by the US employment & rate decisions

- So what is the earnings calendar looking like for the new trading week?

- Baker Hughes oil rig count up 6 to 605

- European indices close with solid gains

- Canada budget balance for April comes in at C$2.66 billion surplus

- Atlanta Fed GDPNow tracker for 3Q growth comes in at 2.1%

- University of Michigan consumer sentiment (final) for July 51.5 vs. 51.1 expectations

- Fed's Waller: a soft landing is a plausible outcome in the US labor market

- VIDEO: The USD moves higher after the higher core PCE inflation numbers today

- A year ago today, the Fed's Bullard made a hawkish pivot: He was right

- Canada May GDP 0.0% vs -0.2% expected

- US June core PCE 4.8% vs. 4.7% expected

- US Q2 employment cost index +1.3% vs +1.2% expected

- The JPY is the strongest while the CAD is the weakest as the NA session begins

- The seasonals were right: July on track to be best month since 2020. What about August?

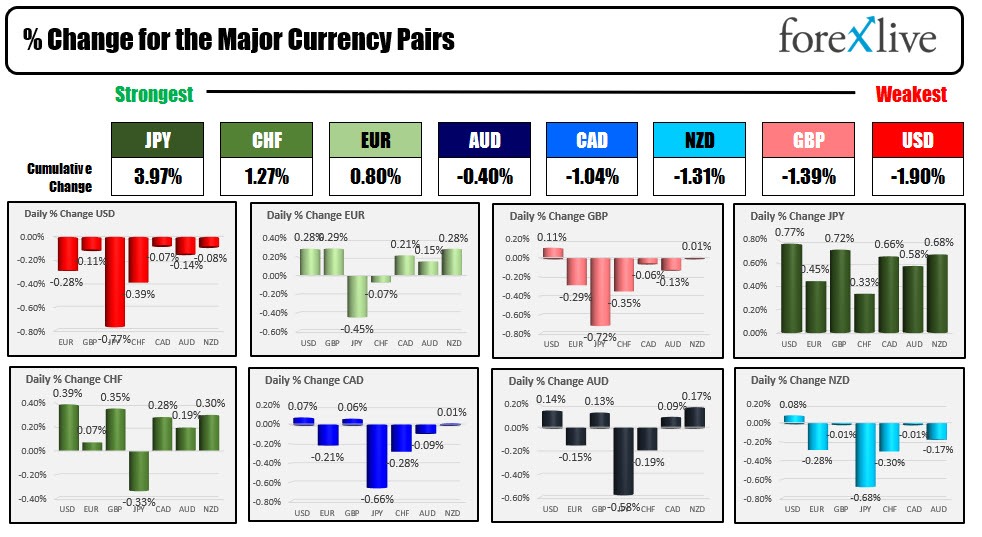

The USD is closing the day lower despite some higher than expected inflation measures at the start of the day. The Core PCE came in at 4.8% trend higher than the 4.7% expected. The employment cost index rose by 1.3% for the quarter which was also higher than the 1.2% expectations. University of Michigan consumer sentiment did rise from the preliminary tumble but was still scraping along historic low levels.

For the US dollar, although the greenback is ending the day as the weakest of the major currencies, initially move higher in the New York session before reversing lower as London/European traders look to exit for the day. Blame it on the month end trading. Overall for the. Month, the dollar was higher vs. the EUR but lower vs. all the other major currencies (the greenback was unchanged vs. the GBP).

So while the dollar was mostly lower this month, the US stock market was mostly higher with the major indices having their best month in 2022 and the S&P and NASDAQ having their best month since 2020.

For the day, the Dow industrial average rose 0.97%, the S&P increased by 1.42% and the NASDAQ index rose by 1.88% for the trading month, those indices had oversized gains of 6.73% for the Dow, 9.12% for the S&P, and 12.35% for the NASDAQ. Admittedly all 3 indices are still lower on the year by quite a bit (Dow down -9.3%, S&P -13.55%, NASDAQ down -20.91%), but the gains are easier on the way higher (off a low base).

In the US debt market, the yields today are ending with mixed results.

- 2 year yield 2.888%, +2.2 basis points

- 5 year yield 2.681%, -2.0 basis points

- 10 year yield 2.656%, -2.4 basis points

- 30 year yield 3.013%, -1.3 basis points

However, for the month yields are lower despite the Fed hiking by 75 basis points.

- 2 year yield closed the end of June at 2.957%. The current yield is 2.888%, down -6.9 basis points

- 5 year yield closed June at 3.040% and is trading at 2.681%, down -36 basis points

- 10 year yield closed June at 3.017% and is trading at 2.654%, down -37 basis points

- 30 year yield closed June at 3.183% and is trading at 3.01% for a decline of -17 basis point

In other markets:

- Gold is ending the day at $1765.34. That's up $9.14 or 0.52%. Gold fell near -$42 this month but that is up from a low that took the price down $-126 at the July 21 low for the month

- Silver rose $0.32 or 1.6% to $20.32. That's near unchanged on the month after declining to a low of $18.14 mid month

- Crude oil is ending up $1.88 or 1.95% at $98.30. For the month, the price is down $7.70 or -7.27%.

- Bitcoin is ending it's Friday near $24,000 at $23,935. Although bitcoin still has 2 days of trading over the weekend, it is currently up around $4000 or 20.10% from its end of June closing level of $19,924

Thank you for your support and have a great weekend.