- US stocks close higher. Two day up streak for the major indices

- Bank of Canada Governor Macklem and Senior Deputy Rogers will testify after the close

- WTI crude oil futures for January delivery settled that $77.94

- RBNZ Orr: We are officially contractionary on policy

- FOMC minutes from the November 2022 Fed meeting: Slowing of pace of rate hikes appropriate

- Baker Hughes oil rig count rises by 4 to 627 from 623 last wk.Nat Gas rigs down -2 in week

- Freddie Mac reports that the 30 year fixed-rate mortgage fell to 6.58%

- Atlanta GDPNow 4.3% versus 4.2% last

- ECB Centeno: 75 basis point interest rate hikes cannot be the norm

- European indices close higher on the day

- BOE Pill: Further rate action likely to be required to ensure inflation will return to 2%

- Crude oil inventories see a draw of -3.691M versus -1.055M estimate

- UK 10 year yield falls below 3% for the first time since September 8

- University of Michigan's consumer sentiment (final) for November 56.8 versus 55.0 expected

- US new home sales 0.632M versus 0.570M estimate

- S&P global November manufacturing PMI for November 47.6 versus 50.0 estimate

- The morning forex technical report for November 23, 2022

- J.P. Morgan: Expects 10 year yields to fall to 3.4% in 2023

- Initial jobless claims for the current week 240K vs 225K estimate

- US durable goods orders for October 1.0% versus 0.4% estimate

- US October housing permits 1.512 million revised from 1.526 million

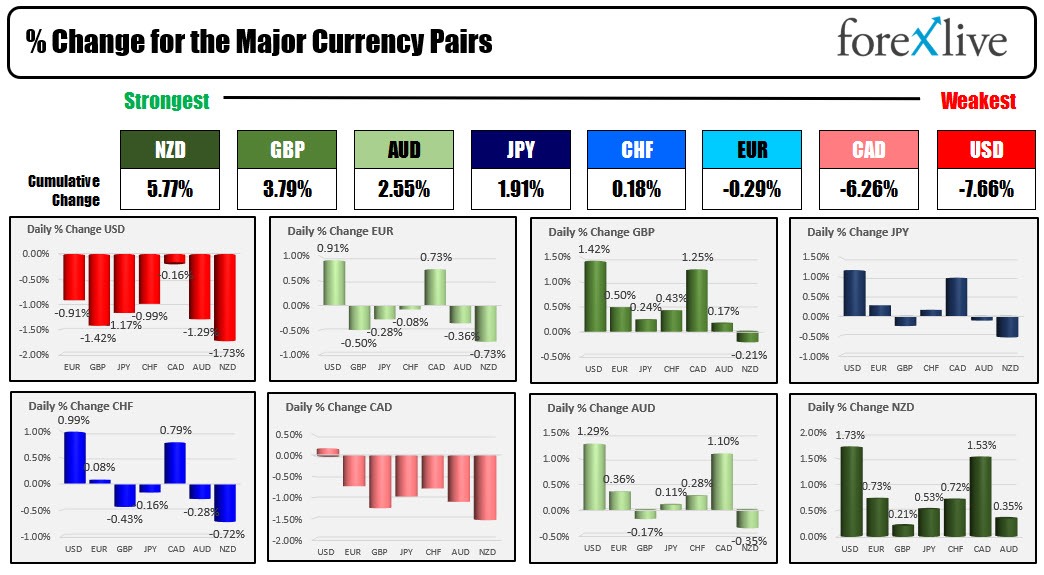

- The GBP is the strongest and the CAD is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar mixed amid tense markets, oil falls

The USD moved lower today on the back of some weaker more timely data. The Initial jobless claims data for the current week moved up to 240K vs 225K estimate. That was a healthy jump and corresponds with other anecdotal stories of job layoffs.

The other piece of data that came in weaker was the S&P Global PMI Flash estimates for November. The manufacturing index fell to 47.6 vs 50 estimate and down from 50.4 . The services index was also lower at 46.1 vs 47.9 estimate and 47.8 last month. The composite index fell to 46.3 from 48.2.

Although Durable goods data was solid and new home sales was also better than expectations (housing is not expected to make any sort of huge comeback for a while), the most recent signals for the economy took precedence. Yields moved lower, the dollar tumbled and stocks were modestly higher for the 2nd consecutive day.

The USD was the weakest with the CAD also weak as oil prices moved to the downside today, nearly erasing all of the gains up from the low from Tuesday that tested the closing level from 31 December 2021 at $75.35. The low today reached $76.85 and is trading at $77.38 near the close.

The strongest of the major was the NZD which benefitted from follow through buying after the RBNZ raised rates by 75 basis points and analysts raised expectations for a higher terminal rate.

In other markets

- Spot gold is up $9.81 or 0.56% at $1749.51

- Spot silver is up $0.44 or 2.13% at $21.52

- Crude oil is down -$3.72 or -4.59% at $77.38

- Bitcoin is trading steady at $16491

In the US stock market today, the major indices all moved higher for the second consecutive day. The Dow moved up and sniffed the August high before backing off. It was the laggard of the top 3 indices. The Nasdaq was the biggest winner as a result of the lower yields today. The final numbers are showign

- Dow up 95.96 points or 0.28%

- S&P up 23.70 points or 0.59%

- Nasdaq up 110.92 points or 0.99%

- The small cap Russell 2000 rose by 3.07 points or 0.17%

Both the US stock and bond markets will closed tomorrow in observance of the US Thanksgiving holiday. Those market will reopen on Friday , but close early for the weekend.