- China inflation recap - factory-gate inflation cooled to its slowest pace in 14 months

- Oil price drop - fresh lockdowns in Shanghai cited

- China CPI for May +2.1% y/y (expected 2.2%) & PPI +6.4% y/y (expected 6.4%)

- NZ fin min says the RBNZ will remain an inflation fighting central bank

- PBOC sets USD/ CNY reference rate for today at 6.6994 (vs. estimate at 6.6998)

- Fitch says Chinese construction companies to face profit pressure on Covid-19 restrictions

- Japan's fin min Suzuki commenting on the weak yen - says nothing indicating intervention

- Reuters poll on Federal Reserve expectations: 50bps in June and July with more to follow

- US politics - January 6 committee broadcast on Trump's coup attempt

- Japan PPI for May +9.1% y/y (expected +10%)

- US administration plans to make it easier to hire workers from central America

- ICYMI - Beijing gives initial nod to revive Ant IPO

- ICYMI - Shanghai to conduct mass COVID testing in 7 of its 16 districts at weekend

- Finnish President, Sweden's King swiftly leave Baltic Sea island as Russian navy approach

- New Zealand data: Manufacturing sales for Q1 drop, Card retail sales in Mya up

- TD see a weaker EUR/USD thanks to the European Central Bank gradualism

- Goldman Sachs sees scope for JPY intervention in USD/JPY, but higher than here

- Druckenmiller: He's too bearish to buy tech stocks, but says they are too cheap to short

- OIl - France, Britain & Germany say they condemn Iran's actions in response to a IAEA

- Druckenmiller says the bear market still has some ways to run

- White House believes CPI will be high due to the flow-through impact of higher oil price

- Yellen wouldn't recommend crypto for most retirement savers, its a very risky investment

- Trade ideas thread - Friday, 10 June 2022

- Yellen says inflation is clearly a major problem, it's what I'm most focused on

- US stock indices close at session lows

- Forexlive Americas FX news wrap: Worries flare up after Lagarde and Macklem

USD/JPY and oil had some movement during the session but otherwise it was sideways across the majors board.

On Thursday USD/JPY dropped from 134.50 during Asia to lows circa 120 points south into the European session. And then, by early in Asia trade, had climbed nearly all the way back up again. The high for USD/JPY was just above 134.40 here as Asia got more underway for Friday, and since then its dribbled back to be straddling 134.00 as I update.

Japan’ s finance minister Suzuki was on the news wires once again trying to ‘jawbone’ USD/JPY lower, but it was off its highs by the time he got in front of the microphone.

Oil lost ground, both WTI and Brent, but the move was minor in the context of the price swings it has seen recently. In the absence of any other catalyst the dribble lower was blamed on concerns over new COVID mass testing programs in China, Shanghai (see bullets above for more).

T he data focus was on inflation, for May, from China. The producer level result was its lowest in 14 months while consumer-level inflation for the month was little changed from April. The focus on this China inflation data was mild compared to the intensity of focus on the incoming US inflation data later today:

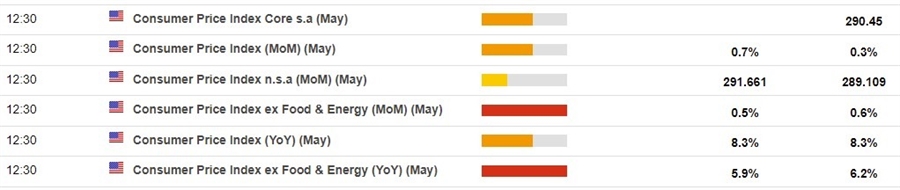

This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month) result. The number in the column next to that, where is a number, is the consensus median expected.