- Australia: Inflation powers through 7% ... Where does this leave the RBA?

- Australian Treasurer Chalmers says expects inflation to peak at the end of the year

- Reports that Universal Studios in Beijing has closed due to COVID restrictions

- Offshore yuan (CNH) higher after PBOC set onshore yuan (CNY) stronger than estimate

- BOJ bids to buy 150bn yen of 25+ year JGBs vs. 100bn planned

- PBOC sets USD/ CNY reference rate for today at 7.1638 (vs. estimate at 7.1983)

- Australia's CPI comes in hotter than expected - in NZ inflation pressure remains 'intense'

- Australian headline CPI 1.8% q/q (expected 1.6%)

- New Zealand ANZ business survey for October: Confidence: -42.7% & Activity: -2.5%

- Japan data - September services PPI 2.1% y/y (expected 1.8%)

- 70% of Japan's life insurers plan to cut holdings of foreign debt, mainly USTs

- Japan MoF Kanda - watching for excessive, disorderly (yen) FX moves

- Japanese authorities will welcome the weak US data overnight, less yen selling pressure

- Morgan Stanley bullish on S&P500 despite expecting a "likely ... sloppy earnings season"

- UK PM Sunak to meet with fin min Hunt - to discuss tax hikes, spending cuts

- South Korea Manufacturing outlook improves, services sector takes a hit though

- NZD traders - note for your diary - RBNZ Governor Orr to speak in 24 hours

- Goldman Sachs: The Bank of Canada meeting is a close call, important implications for CAD

- Trade ideas thread - Wednesday, 26 October 2022

- Oil - private survey of inventory shows larger than expected headline build

- Forexlive Americas FX news wrap: US dollar sinks, consumer confidence plunges

- Major US stock indices close higher for the 3rd consecutive day

The Bank of Japan is meeting later this week, the statement is due on Friday. Today the Bank bought more JGBs than they planned across the maturities curve. There is persistent chatter that the BOJ will abandon its YCC control policy. The policy is directed at 10 year JGBs, and the bank has been successful at keeping yields below their desired cap at this maturity. Meanwhile, though, higher yields have leaked across to other maturities, and have been doing so for months. Today’s action from the BOJ goes some way to addressing this inconsistency. It’ll be unlikely to resolve the higher yield issue for an extended period of time, but it does signal the Bank will not be dropping YCC this week.

USD/JPY has moved higher on the session.

Elsewhere inflation was in the spotlight. We had the ANZ New Zealand Business Survey highlighting that inflation pressure there remains ‘intense’ (see the NZ business confidence and activity post above for more on this). Soon after we had Australia’s official CPI report for Q3. Headline and core (trimmed mean) inflation came in above expectations and accelerating from Q2. The Reserve Bank of Australia switched to a +25bp rate hike in October, from +50s in the months prior, but the data today at least raises the question of a return to +50 at the November meeting. This meeting is next week, on Nov. 1. Given the RBA and Treasury were expecting higher inflation (and for it to top in the December quarter) it seems unlikely today’s data is enough to prompt a 50bp hike next week. I had better not mention how (not) good RBA inflation forecasting has been though. If their forecasting is bad, their overconfidence is worse.

Analysts in Australian banks (CBA and ANZ, for example) have revised their forecasts for RBA rate hikes higher in the wake of the data.

AUD/USD initially spiked above 0.6400 on the data but has since subsided back to be little changed on the session.

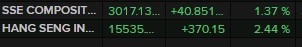

The People’s Bank of China set the CNY reference rate stronger than expected for the CNY (i.e. a lower than expected USD/CNY). Chinese mainland and HK shares rose again.