- Buffett’s Berkshire Hathaway boosted its stake in Japanese trading houses

- Weaker yuan, persistent capital outflows limit PBoC ability to ease monetary conditions

- USD has generally moved higher in Asia Monday trade as sentiment has slipped

- Fed, ECB and BoE speakers due Monday 21 November 2022

- NZ credit card spending for October +1% m/m (prior +0.6%)

- Goldman Sachs cuts Brent oil forecast by $10 due to China and Russia concerns

- PBOC sets USD/ CNY mid-point today at 7.1256 (vs. estimate at 7.1203)

- PBOC LPR setting: 1-year and 5-year both unchanged

- South Korea exports y/y fell hard in the first 20 days of November

- A Magnitude 6 earthquake has hit Crete, Greece

- China COVID update - a district in Guangzhou has imposed a 5-day lockdown

- HSBC "remain constructive on China", maintain their 5.2% growth forecast for 2023

- RBNZ +50 or +75 cash rate hike this week - the larger one would prop up the kiwi $

- Trade ideas thread - Monday, 21 November 2022

- RBNZ Shadow Board majority view is for a +75bp interest rate hike (cash rate to 4.25%)

- Denials from UK officials on talk that UK PM Sunak considering Swiss-style links with EU

- Beijing's most populous district urges residents to stay at home - COVID outbreak

- Social media chatter that Digital Currency Group owes US$1.1 bn to Genesis

- Collapsed Cryptocurrency exchange FTX owes its 50 biggest creditors nearly US$3.1 bn

- The weekend forex technical report for the week starting November 21, 2022

- Newsquawk Week Ahead: Highlights include Fed & ECB mins, PBOC, RBNZ, Flash PMI's

- Fed's Bostic: I'm ready to move away from 75 bps increments at the December meeting

The rise in COVID cases in China has prompted renewed lockdowns in the country, and other restrictions. It looks like the China coronavirus ‘pivot’ is yet to happen. China is heading into winter, a high-risk season, any pivot may have to wait until after this.

In addition, China officially reported its first Covid-related deaths since the Shanghai lockdown. This, of course, strains credulity. No one, no one at all, believes that there have been no virus-related deaths since Shanghai. Its difficult to believe anything but the worst when officials in China feed out such blatant lies.

In the region stock markets wobbled on the news. The Hang Seng index in Hong Kong fell more than 2.5%. Mainland China saw the Shanghai Composite and Shenzhen both off just over 1%. Japan’s Nikkei is not a lot net changed.

Across major forex rates, the move was into US dollars. EUR, AUD, GBP, NZD, CAD all fell against the USD. USD/JPY was fairly stable though.

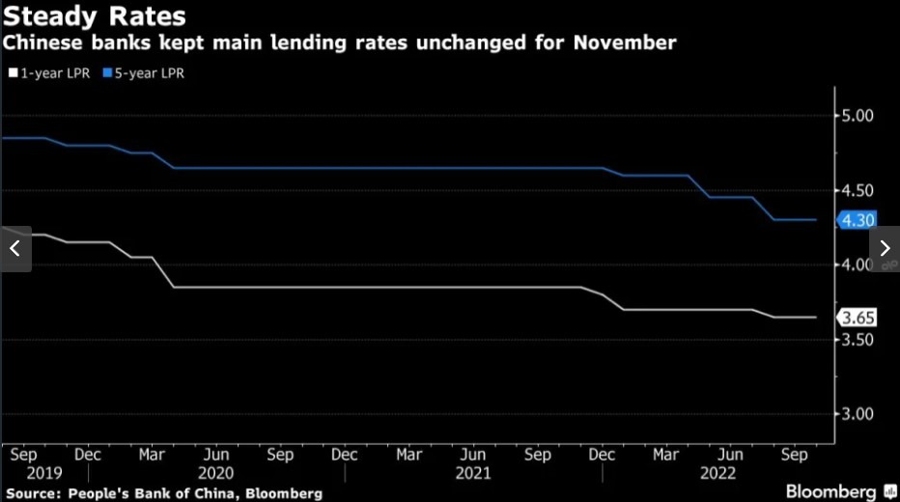

In central bank news the People’s Bank of China set the one- and five-year loan prime rates (LPR) unchanged for the third straight month. As expected, given that last week the PBOC partially rolled over maturing medium-term facility loans (MLF) at an unchanged interest rate. The MLF rate is used as a guide to the LPR rate setting:

- the one-year loan prime rate (LPR) was kept at 3.65%

- the five-year LPR at 4.30%

From South Korea today we had trade data for the first 20 days of the month. In another sign of woes in the Chinese economy exports from SK to China slumped more than 28% y/y.

Bitcoin slid back just under US$16K. Sentiment in the crypto complex has suffered after the FTX implosion.

China LPRs (graph via Bloomberg):