Missile attack on Poland:

- European Union recommits to holding Russia accountable for its attacks on Ukraine

- Biden says preliminary intelligence contests missile that hit Poland was fired from Russia

- Polish President Duda says no definitive evidence of who fired the rocket

- Polish foreign ministry says Russian-produced rocket fell on Polish village Przewodów

- NATO SecGen Stoltenberg will chair an emergency meeting of NATO Wednesday morning

- Polish government spokesperson says raising readiness of military units

Other:

- Morgan Stanley says Apple iPhone Pro will fall short of earlier shipment estimates by 6mn

- Bank of England Gov. Bailey, Dep. Broadbent, MPC members Mann & Dhingra are speaking today

- TD sees scope for broad CAD underperformance early in 2023

- China's state planner NDRC approves fixed asset projects worth 9 bn yuan in October

- RBNZ meet next week - preview - "likely to deliver an outsized 75bps hike to 4.25%"

- Trump files statement he will be running for President in 2024

- Ken Griffin of Citadel says US playing with fire by depriving China of semiconductor tech

- China October home prices -0.37% m/m, falling faster than September's -0.28%

- Deutsche Bank forecasts for EUR/USD (and others) out to the end of 2025

- PBOC sets USD/ CNY mid-point today at 7.0363 (vs. estimate at 7.0409)

- Australian data - Q3 wages +1.0% q/q (expected +0.9%)

- Awful Japanese Machinery Orders data - government cuts machinery orders assessment

- Australian data - Westpac's leading index of economic growth "continues to sag"

- National Australia Bank forecast RBA peak cash rate at 3.6%, held there until early 2024

- IMF says Australia should keep tightening monetary & fiscal policy to contain inflation

- UK PM Sunak - China's authoritarian leadership is intent on reshaping international order

- Westpac: RBA titled dovish when its increasing its inflation forecast ... unusual approach

- Barclays forecasts EURCHF trading around parity for the next few quarters

- Trade ideas thread - Wednesday, 16 November 2022

- Oil - inventory survey shows a large draw, much larger than expected

- China’s largest property developer wants to raise half a billion $

- US stocks close higher but lose some steam on Russian fears

- Forexlive Americas FX news wrap: PPI hits dollar but the trade doesn't last

USD/JPY was once again the mover, trading up to approach 140.00 on the session. It had dipped under 139.00 early.

Apart from yen crosses moves across major FX rates were subdued.

Poland, the G20, G7 and NATO dialled down their response to the Tuesday missile attack on Poland. Poland and NATO used language that suggested they were not treating the missile blast as a Russian attack. Later in the session US President Biden did the same. The de-escalation saw a small move out of the USD (USD/JPY excepted).

From China we had the mainland reporting more than 20,000 local COVID-19 cases today. This is the highest since April.

From Australia we had wages data. The q/q result was the highest since March of 2012, beating the expected +0.9% q/q rise to come in at +1.0%. This is still well under the inflation rate, that is, real wages are falling. The result is higher than the RBA forecast, but given the RBA dismissed the latest surging inflation data (they say they are data dependent, they are not) the wages data is not going to prompt a +50bp rate hike at the December (6th) meeting. +25 appears to be the base case.

Former US President Trump announced his candidacy for the 2024 Presidential election.

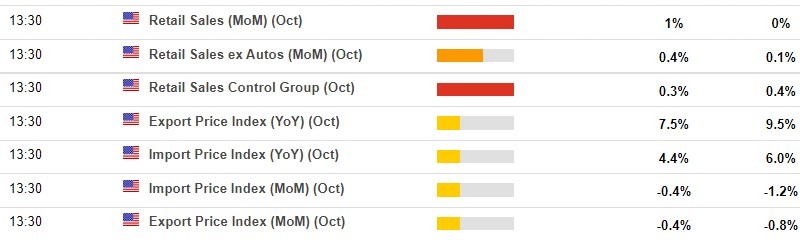

Still to come from the US on Thursday are retail sales data for October. These are eagerly awaited. After last week's cooling US CPI inflation figures and the same from Tuesday’s PPI results, a retail sales figure below expectations will be another positive input for US equities, signalling to the Federal Reserve that its time to ease back on hikes for now, a direction the Fed has indicated its favouring.