UPCOMING EVENTS:

Monday: US ISM Services PMI.

Tuesday: RBA Policy Announcement.

Wednesday: BoC Policy Announcement.

Friday: University of Michigan Consumer Sentiment.

Last week we had three important events: the US ISM Manufacturing PMI, Fed Chair Powell speech and the US Labour Market report. Since the last CPI report, the US Dollar has been brutally beaten with the USD/JPY chart showing the incredibly fast unwind in long positions.

USD/JPY Daily chart

The market switched to risk-on mode as the inflation rate is expected to fall due to the aggressive monetary tightening and the upcoming recession, and the Fed expected to become less aggressive beginning with a slower pace of hikes from the December meeting onwards and ending with a pause sometime in Q1/Q2 2023. We don’t know yet where the inflation rate is going to settle, but the market for now runs on such optimistic expectations. At some point, the focus will switch back to the recession, but we need a catalyst for that.

Leading indicators like ISM PMIs, consumer sentiment, inverted yield curve and so on have been signalling a bad recession coming soon. In fact, the US ISM Manufacturing PMI on Thursday, which is considered as one of the most important and reliable leading indicators, dipped into contractionary territory for the first time since May 2020 and all the other components showed further declines compared to the previous report.

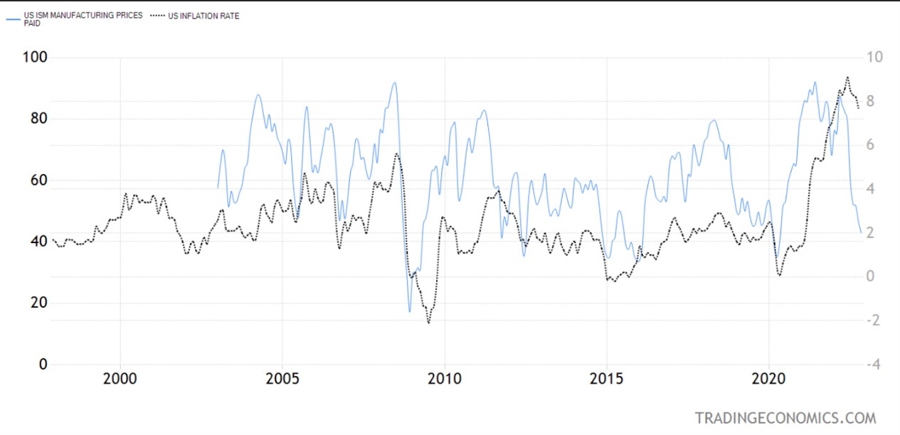

The good news here is that this should lead to lower price pressures going forward with the prices paid sub-index showing further declines to levels not seen since May 2020. Prices paid in the ISM PMI report generally lead the inflation rate.

On Wednesday, Powell basically sealed a 50 bps hike coming at the December meeting. The market was expecting hawkish comments because financial conditions eased after the latest FOMC meeting (stocks up, yields down). Instead, what we've got was pretty much the same thing we heard in Powell's FOMC press conference BUT with two "dovish" comments:

• "I don’t want to overtighten", which goes somewhat against his latest comment “The risks are asymmetric. If the Fed does too much, it can cut. If it doesn’t tighten enough, then you’re in real trouble.”

• In the FOMC press conference he said, "we have a ways to go with interest rates before we get to the level that is sufficiently restrictive", but yesterday he said "Have made substantial progress towards sufficiently restrictive policy, but have more ground to cover".

These subtle changes in the language is something the market always pays attention to in order to anticipate the next central bank moves. In fact, his speech led to more US Dollar weakness and more easing in financial conditions.

Finally, the US Labour Market report on Friday surprised beating yet again expectations. Two things in particular caught the market’s attention: the divergence between the establishment and household survey, and the average hourly earnings coming in hot with a higher revision for the previous report.

Here’s what CIBC had to say about the jobs figures: “The household survey, which is more volatile than the payrolls survey in a given month, but is often considered a leading indicator of the payrolls count around turning points in the economy, showed a loss of 138K jobs, adding to job losses in the prior month. After stripping out the self-employed to get a measure more comparable to payrolls, including this month's dip, household survey non-farm employment is roughly unchanged from March 2022 levels.”

So, the market may be more focused on that and that’s why we have seen US Dollar strength in reaction to the report, but subsequent weakness ending the day at basically the levels before the report. The higher wages though should make the picture more uncertain for the current narrative of the Fed pausing in H1 2023 at a terminal rate somewhere in the 5% area. Net-net, this report just added more confusion to the picture.

This week the market should be focused mainly on the US ISM Services PMI on Monday. The Fed is in blackout period ahead of its 13-14 December meeting next week. As previously mentioned, the FOMC is widely expected to hike by 50 bps and show a consensus of a higher terminal rate compared to their last projections, which will probably be in the 5% area as the market expects.

Monday: The US ISM Services PMI is expected to show an increase to 55.6 from the prior 54.4. While the manufacturing sector is more sensitive to changes in business cycles and interest rates, the services sector is less so and it’s also by far the biggest component in consumer spending and employment. The market will want to see further deterioration in the data to support the current narrative and will focus especially on the prices paid sub-index which fell much less than the manufacturing counterpart and even showed an increase the last month.

Tuesday: The RBA is expected to hike by 25 bps and bring the cash rate to 3.10%. The RBA stated that it’s not on a pre-set path regarding rate hikes and that it can switch to more aggressive hikes if necessary. They remain data dependent but not showing signs of urgency in increasing the size of rate hikes even though the last inflation report surprised to the upside.

Wednesday: The BoC is expected to hike by 50 bps and bring their overnight rate to 4.25%, although money markets are pricing a higher chance for a smaller 25 bps move. The BoC Governor Macklem suggested in October that the end of their tightening cycle may be near. Central Banks seem fine taking the gamble of slowing/pausing rate hikes with inflation rates still at very high levels. If the data support their move, they may be fine, but another wave of inflationary pressures may send the markets into panic.

Friday: The University of Michigan Consumer Sentiment Survey was a market moving report at the peak of inflation and recession fears. Now, it just keeps on showing the deterioration in consumer sentiment and signalling that the worst is yet to come for the economy. The market is also attentive to the inflation expectations in the survey for 1 and 5 year out, which recently ticked higher.

This article was written by Giuseppe Dellamotta.