UPCOMING EVENTS:

- Monday: US Independence Day (holiday).

- Tuesday: RBA Monetary Policy announcement.

- Wednesday: US ISM Services PMI, FOMC Minutes.

- Thursday: Fed’s Waller and Fed’s Bullard speak.

- Friday: US Labour Market Report.

The week begins with a US holiday which should see lower liquidity and lower trading volumes and lead to some choppy price action. Nonetheless the very bad US ISM Manufacturing PMI on Friday and the revision in the Atlanta Fed GDPNow point to the US probably being already in recession. This coupled with a Fed that as of now cannot afford to pause or ease its policy tightening, should lead to more losses in risk assets and general risk aversion .

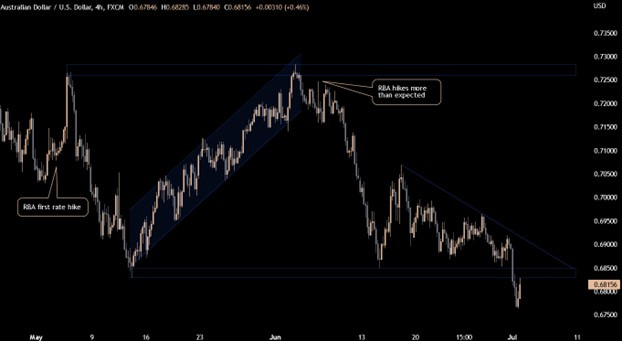

On Tuesday the Reserve Bank of Australia (RBA) is expected to hike the cash rate by 50 bps bringing it to 1.35%. The RBA stated that it is committed to do what is necessary to bring inflation down to target over time and the aggressiveness will be decided based on incoming data. From a trading perspective, in a synchronised global slowdown a commodity currency like the AUD suffers no matter how much the RBA hikes. The recent AUD spikes on RBA hikes were all eventually faded as you can see in the AUD/USD chart below. Will this be another fade?

On Wednesday the US ISM Non-Manufacturing PMI is expected to show another dip in the survey as the deteriorating economic environment weighs on activity. Note though that the services sector is not as cyclical as the manufacturing sector. During tough times, consumers slash spending first on the pricey manufactured goods like cars, furniture and so on, but they will do that much slower for services as there’s always demand for medical care, transportations, and communications.

That’s why the ISM Manufacturing PMI is a better forecasting tool of future economic conditions even though services make up for 80% of consumer spending. The market will be more focused on the prices sub-index to see if there’s some cooling on the inflation side, but even if there is, unless it’s a huge one, the economy is still headed for tough times exacerbated by tightening monetary conditions by the Fed.

The FOMC Meeting Minutes shouldn’t offer anything new regarding future policy actions, as the Fed is trying to be as transparent as possible when signalling its future policy moves, even if it has to supposedly give some inside info to a journalist right before a decision. Also, a key change in a line in their latest statement suggests that the Fed will go hard on fighting inflation even if it will cause some job losses.

On Thursday we will hear from Fed’s Waller (Hawk, Voter) and Fed’s Bullard (Hawk, Voter). They may give some comments on recent economic data, which the market may focus on to take clues about the aggressiveness of their future policy moves. Right now, it’s a debate between a 50 or 75 bps hike at the upcoming July meeting, although the debate takes a less bigger stage compared to the tightening during a recession.

Finally on Friday, the US Bureau of Labour Statistics will release the latest labour market report. The market expects job gains to start cooling with the consensus looking at a 295K gain compared to the previous 390K. Of course, the main focus of the market now is inflation and recession, so the market will move more in case of big losses in jobs or increases in average hourly earnings, with the latter weighing more in the debate whether the Fed will raise rates by 50 or 75 bps at the next meeting.

In the bigger picture though, we are clearly in a recessionary cycle coupled this time with an aggressive Fed tightening. For the Dollar Smile Theory, the US Dollar generally appreciates during a synchronised global slowdown or when the US economy outperforms its peers. The USD has been racking up in gains for a year now and there’s little indication it shouldn’t keep on doing so. The EUR/USD chart below is on the brink of a breakout lower, which would reinforce calls of a parity between the two major currencies.

This article was written by Giuseppe Dellamotta.